Americans are Feeling More Jolly

It’s been a puzzle as to why Americans seem to be in a funk, despite strong economic growth, low unemployment, rising incomes (even after adjusting for inflation), and even strong consumption trends. In other words, Americans were out and about spending, on the back of strong incomes, but confidence was plunging. The University of Michigan …

Here Comes the Santa Claus Rally🎅❄🎄🎁🦌

“If Santa should fail to call, bears may come to Broad and Wall.” —Yale Hirsh One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December; it’s actually only seven days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now …

Four More Reasons ’24 Should Be a Good One for the Bulls

“Investing is like dieting. It is simple, but not easy.” Warren Buffett, Chairperson at Berkshire Hathaway It was a year ago this week that we moved to overweight equities and we’ve been there ever since. Obviously, this wasn’t a very popular call, as nearly everyone else on Wall Street was expecting a recession and the …

Business Management

Peter Lazaroff: Embracing Artificial Intelligence

Artificial intelligence is revolutionizing financial advisory. How will AI impact investors’ portfolios? This week on Framework, Ana Trujillo Limón, Director, Coaching and Advisor Content, and Odaro Aisueni, Wealth Planner, speak with Peter Lazaroff, Chief Investment Officer at Plancorp, LLC, about the impact of AI on financial planning, and the importance of diversification in investment portfolios. …

Start Strong and Dream Bigger: Your Framework for Goal Setting for 2024

Famed Italian artist Michelangelo said, “The greatest danger for most of us is not that our aim is too high and we miss it, but that it is too low and we reach it.” If you’re reading this, you’re likely in one of three categories: You love goal setting, and you’re constantly searching for new …

Flip the Script: How Sponsors Can Increase Representation of Women in Wealth Management

In her more than two decades in the financial services industry, Clara Sierra hasn’t had many sponsors. “I’ve had many, many, many mentors,” said Sierra, who is a senior director at Moody’s Analytics. “But I would say I have only had two sponsors.” As a woman and as an Afro-Latina, sponsors are few and far …

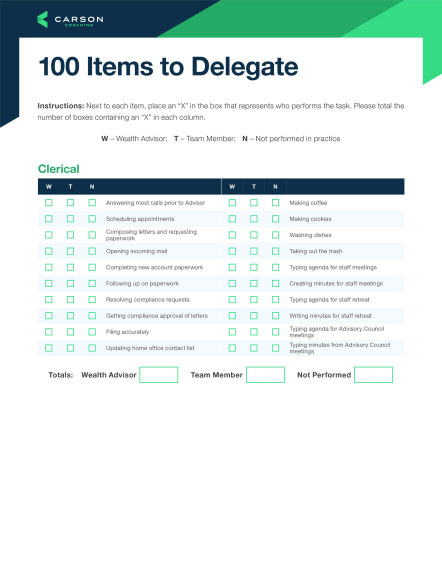

100 Tasks Every Advisor Should Delegate

Find out what tasks you can hand off to free up your time and empower your team.

Marketing

Six Key Steps to Creating an Effective Financial Advisor Marketing Plan

It’s easy to be equal parts dazzled and overwhelmed by the fast-evolving world of marketing and the many ways to get the word out about your financial advisory business. Videos, podcasts, social media and webinars are all on the radar of financial advisors who appreciate the power of marketing to grow their business. In reality, …

Best Practices for Harnessing the Power of Email Marketing for Financial Advisors

Email marketing for financial advisors is a powerful way to engage with clients and prospects. By leveraging the benefits of email marketing, financial advisors can stay top of mind, provide valuable content and foster trust – ultimately driving business growth. However, a successful strategy entails more than just writing down your thoughts and hitting “send.” …

Lead Generation for Financial Advisors: How to Generate, Develop and Convert Leads for Your Firm

Lead generation for financial advisors is a critical component of a successful growth strategy, but it requires a thoughtful approach if you want to avoid wasted effort and connect with qualified prospects. A good lead generation strategy will leverage digital advertising, event networking, connecting with centers of influence and other mediums, but how can you …

The Financial Advisor's Guide to Effective Marketing

Effective advisor marketing in the digital age requires a strategy that fits your firm.

Compliance

Understanding the SEC Marketing Rule for Financial Advisors

In late 2020, the SEC announced that it had finalized changes to its Marketing Rule for financial advisors. The amendments create a single rule that replaces the pre-existing advertising and cash solicitation rules. The rule’s broadly drawn limitations and principles-based provisions are designed to accommodate the continual change in technology and ever-expanding ways in which …

Staying on Top of SEC Marketing Rule Changes

Changes to the Securities and Exchange Commission’s “Marketing Rule” recently went into effect, and they impact everything from testimonials to the definition of an “advertisement.” Staying in compliance with these rule changes can be challenging for advisors, but our on-demand webinar “Staying on Top of SEC Marketing Rule Changes” can help you stay on track. …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

The SECURE Act brought big changes to retirement planning when it was signed into law in 2019. Now, its sequel – dubbed SECURE 2.0 Act – has just passed as part of the 2023 budget. Though SECURE 2.0 Act’s changes to the retirement landscape aren’t quite as sweeping as the original, there’s still plenty advisors …

Staying on Top of SEC Marketing Rule Changes

Learn how to stay in compliance with SEC rules when using client testimonials and reviews.

Technology

Power Your Technology and Enhance the Client Experience with Data

Thanks to rapidly advancing technology, financial advisors have access to more data than ever before. But trying to sift through that data and actually use it to enhance your business and client experience can be a challenge. How can you be sure you’re measuring the right metrics, or interpreting the data correctly? How can you …

Our Favorite Financial Advisor Tools to Add to Your Tech Stack

As financial advisors grow their businesses, their operational needs can drastically change, along with the need to provide competitive services. That’s where financial advisor technology comes in. The best financial advisor tools will enhance your processes, save you time and money and foster connections with clients about their specific goals. Today’s technology offerings can …

Eight Common Advisor Technology Pitfalls and How to Avoid Them

In a world where there’s an app for everything, client expectations around technology are greater than ever and cyber threats are on the rise, financial advisors find themselves navigating an extremely complex technology landscape. From back office to client engagement to portfolio management systems and platforms, advisor technology is critical to being effective, meeting …

Building a Top-of-the-Line Tech Stack

An accessible, user-friendly tech stack is crucial to delivering the best client experience.

Investments

Americans are Feeling More Jolly

It’s been a puzzle as to why Americans seem to be in a funk, despite strong economic growth, low unemployment, rising incomes (even after adjusting for inflation), and even strong consumption trends. In other words, Americans were out and about spending, on the back of strong incomes, but confidence was plunging. The University of Michigan …

Here Comes the Santa Claus Rally🎅❄🎄🎁🦌

“If Santa should fail to call, bears may come to Broad and Wall.” —Yale Hirsh One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December; it’s actually only seven days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now …

Four More Reasons ’24 Should Be a Good One for the Bulls

“Investing is like dieting. It is simple, but not easy.” Warren Buffett, Chairperson at Berkshire Hathaway It was a year ago this week that we moved to overweight equities and we’ve been there ever since. Obviously, this wasn’t a very popular call, as nearly everyone else on Wall Street was expecting a recession and the …

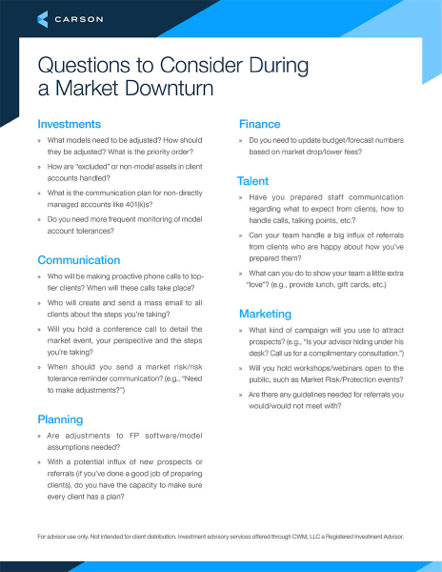

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable.

Financial Planning

Financial Planning Software for Advisors: What You Need to Know to Streamline Your Business and Engage Your Clients

As financial advisors aim to provide more value to their clients, they’ve turned to technology to boost efficiency while providing more comprehensive services. But knowing what to use and when can be a puzzle. In the wide world of financial planning software for advisors, knowing what best fits your firm can be difficult. At …

Niches for Financial Advisors – How to Find Your Ideal Client

If you’re establishing or growing your practice as a financial advisor, you’ve likely heard that gearing your services toward a specific client base can accelerate your growth. Indeed, niches can offer several significant benefits, like helping you build connections and trust with clients. Niches for financial advisors are virtually unlimited. They can include clients …

The SECURE 2.0 Act’s Impact on Roth IRAs

As a special Christmas present to all of us, the SECURE 2.0 Act became law right before the holiday. The SECURE 2.0 Act caught a ride on the $1.7 billion omnibus spending bill that was unveiled on December 19. While the bill presents numerous changes to existing retirement savings and withdrawal rules, as my present …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

Stay on top of the shifting retirement planning picture.

M&A

How to Calculate and Maximize Your Financial Advisor Valuation

As you run your financial advisory practice, in the back of your mind you realize you’re building a valuable business. But do you know just how valuable? You could be pleasantly surprised. Market valuations of RIAs have roughly doubled over the past five years thanks to strong M&A demand from large-scale advisory practices, consolidators and …

The Comprehensive Guide to Succession Planning for Financial Advisors

You tell your clients they shouldn’t leave retirement planning to the last minute. The same applies to your business – specifically, with succession planning for financial advisors. Ideally, when you leave, you smoothly transition your clients and staff to another advisor who fairly compensates you for the book of business. But this process doesn’t …

The Complete Guide to Selling Your Financial Advisory Business

The RIA landscape is enjoying historic valuations as bidding on these firms by other RIAs, broker-dealers, banks and private equity firms drives up prices. The interest is understandable. McKinsey reports RIAs have achieved 12% annual growth in assets since 2016, making them the fastest-growing category in the U.S. wealth management market. At Carson Group, …

The Essentials of Succession Planning for Financial Advisors

Learn how to choose a successor and find the true value of your firm.

Get Expert Market Insights

The Carson Investment Research weekly newsletter offers up-to-date market news and analysis that could help you serve as a better guide for your clients. Subscribe today!

"*" indicates required fields