Americans are Feeling More Jolly

It’s been a puzzle as to why Americans seem to be in a funk, despite strong economic growth, low unemployment, rising incomes (even after adjusting for inflation), and even strong consumption trends. In other words, Americans were out and about spending, on the back of strong incomes, but confidence was plunging. The University of Michigan …

Here Comes the Santa Claus Rally🎅❄🎄🎁🦌

“If Santa should fail to call, bears may come to Broad and Wall.” —Yale Hirsh One of the little-known facts about the Santa Claus Rally (SCR) is that it isn’t the entire month of December; it’s actually only seven days. Discovered in 1972 by Yale Hirsch, creator of the Stock Trader’s Almanac (carried on now …

Four More Reasons ’24 Should Be a Good One for the Bulls

“Investing is like dieting. It is simple, but not easy.” Warren Buffett, Chairperson at Berkshire Hathaway It was a year ago this week that we moved to overweight equities and we’ve been there ever since. Obviously, this wasn’t a very popular call, as nearly everyone else on Wall Street was expecting a recession and the …

Discussing NDR’s 2024 Outlook with Ed Clissold

With 2024 just around the corner, there are big uncertainties for the U.S. economy regarding inflation, interest rates, political uncertainty, and a possible recession. How can investors navigate this complex and volatile environment? What are the sectors to look at? In this episode, Ryan Detrick, Chief Market Strategist at Carson Group & Sonu Varghese, VP, …

Pioneering Progress: A Compelling Need for a Fund Solely Focused on Women in Leadership

Background: A Shifting Environment Focused on Aligning Investment and Values The investment landscape is undergoing a paradigm shift, characterized by investors increasingly seeking to harmonize their financial portfolios with their deeply held beliefs and values. Thematic investing has emerged as a powerful avenue for clients to translate their convictions into tangible financial actions. This approach …

Thoughts on Investing with Peak Interest Rates

The Federal Reserve (Fed) has indicated a potential pause in interest rate hikes and the futures market suggests cuts might occur in early to mid2024 if inflation continues to ease. As the consensus shifts towards interest rates currently being at their peak, attention turns to investments that historically perform well when the Fed starts to …

All About Dow New Highs

“Don’t count the days, make the days count.” -Muhammad Ali In the face of many worries, stocks have put together a historic year in ’23. To top things off, the Dow just hit a fresh new all-time high, its first new high since January 4, 2022. New Highs Happen More Than You Think Interestingly, …

The Inflation Problem Is Easing, and the Fed Expects to Cut Rates

Wednesday, December 13th, was important for two reasons: The Federal Reserve (Fed) acknowledged that inflation is easing quite rapidly, and they plan to respond with rate cuts. The November producer price index (PPI) indicated that core inflation is back at the Fed’s target. Let’s start with the Fed meeting. A Data Dependent Fed Bows to …

This Is Likely the Best Investment Over the Next 5 Years

If you’re wondering what the investment is, I’m referring to stocks. More specifically, US stocks. At Carson Investment Research, we just moved our longer-term strategic asset allocations to their maximum equity overweight. Stocks may very likely gain 75-100% cumulatively over the next 5 years, which is 12-15% annualized. If you look back at history, the …

Good News is Good News

The U.S. economy has been showing signs of strength, despite the challenges posed by the pandemic and ever-evolving global uncertainties. One of the most encouraging indicators is the unemployment rate, which fell to 3.7% in November. What does this mean for the markets? What is the outlook for 2024? In this episode, Ryan Detrick, Chief …

The Time To Get Back Into Bonds

Probably the top fixed income question we’ve received in 2023 is when it’s appropriate to begin moving bond allocations from ultra-short-maturity bonds and money market funds back into core bonds. Gauging by 2024 rate hike expectations, the answer is probably sometime around now. The “perfect” time, assuming rates have peaked, was October 19 of this …

Download A Complimentary Resource

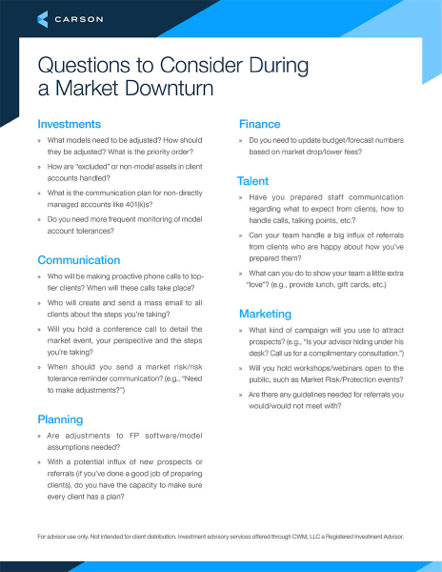

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable.