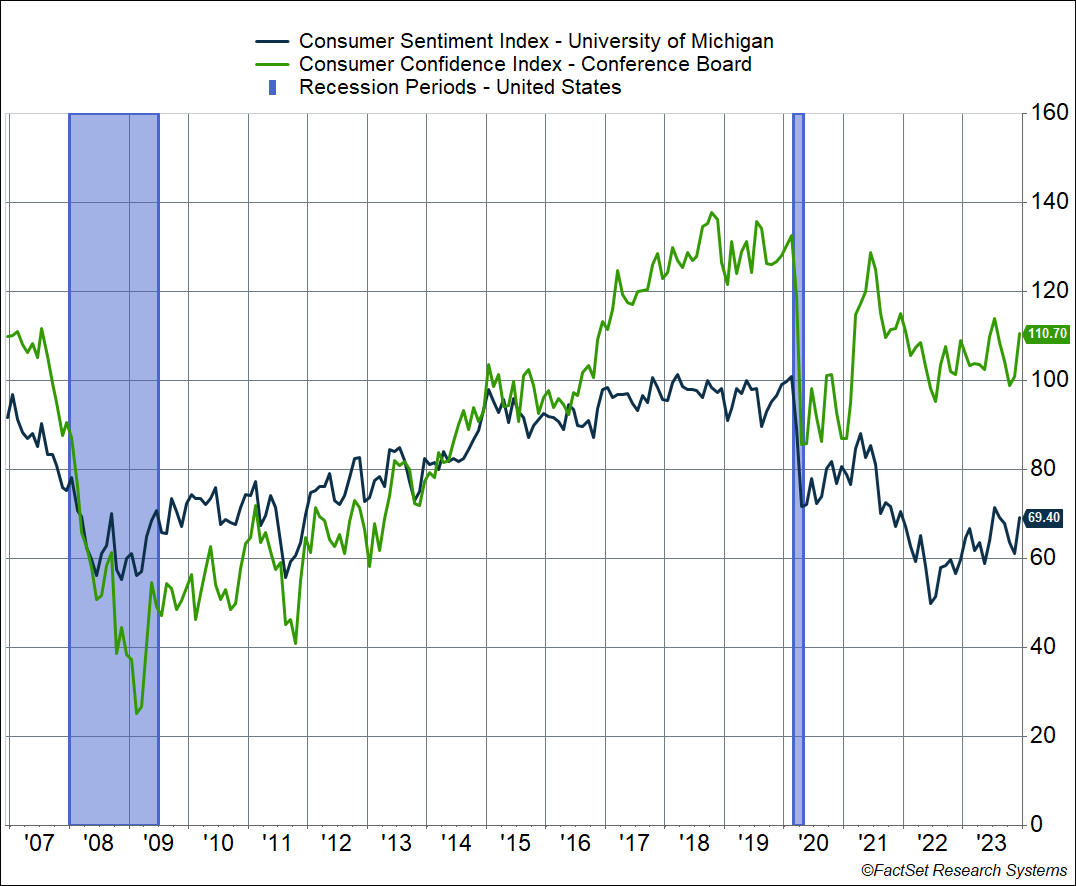

It’s been a puzzle as to why Americans seem to be in a funk, despite strong economic growth, low unemployment, rising incomes (even after adjusting for inflation), and even strong consumption trends. In other words, Americans were out and about spending, on the back of strong incomes, but confidence was plunging. The University of Michigan consumer confidence index hit levels below what we saw in 2020 amid the pandemic, and even during the Great Financial Crisis. The Conference Board’s measure wasn’t as bad, but even that index was well below levels we saw prior to the pandemic. My colleague Barry Gilbert, VP, Asset Allocation Strategist, termed this “irrational sullenness”.

But this may be changing …

Tis’ the Season to Be Jolly, and It Seems to Be Catching On

Both measures of confidence have now risen for two months in a row. In December, the Conference Board saw the largest monthly increase since early 2021.

There are probably three big reasons why confidence is rising.

One, stocks have rallied recently. The S&P 500 has rallied almost 16% since October 27, which was when Carson’s Chief Market Strategist Ryan Detrick called the bottom for this most recent downturn . All of which has led to the S&P 500 gaining almost 26% this year, including dividends. That’s cause for cheer by itself, but even better since it’s entirely erased last year’s losses.

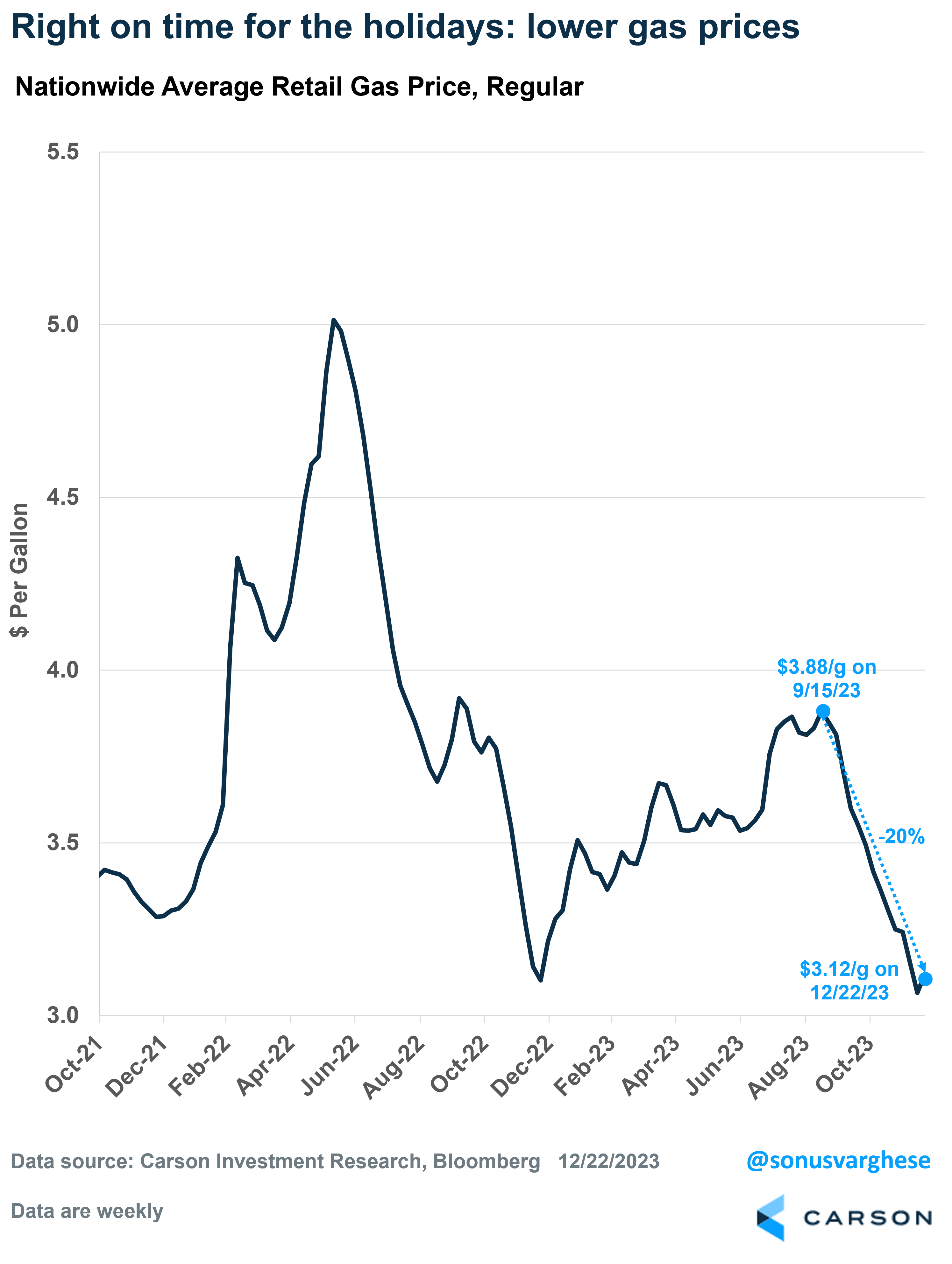

Two, gas prices have fallen 20% since mid-September. Nationwide average gas prices have fallen from $3.88/gallon in mid-September to $3.12/gallon now. That’s as a good a Christmas present as any. Gas prices are perhaps the most salient part of inflation, and lower prices give households the perception that inflation is actually easing, never mind what official data says.

Three, 30-year fixed mortgage rates have fallen from 8% to almost 6.5%. Thanks to markets pricing in interest rate cuts by the Federal Reserve next year, mortgage rates have fallen sharply. Obviously, even 6.5% is higher than the mortgage rate most homeowners pay, which is 3-4%. However, there’s a massive cohort of 25-34 years who want homes but are being priced out right now, assuming they can even find a home to buy. Lower mortgage rates boost perceptions of home affordability.

Combine the above three with three other positive factors that are already in place.

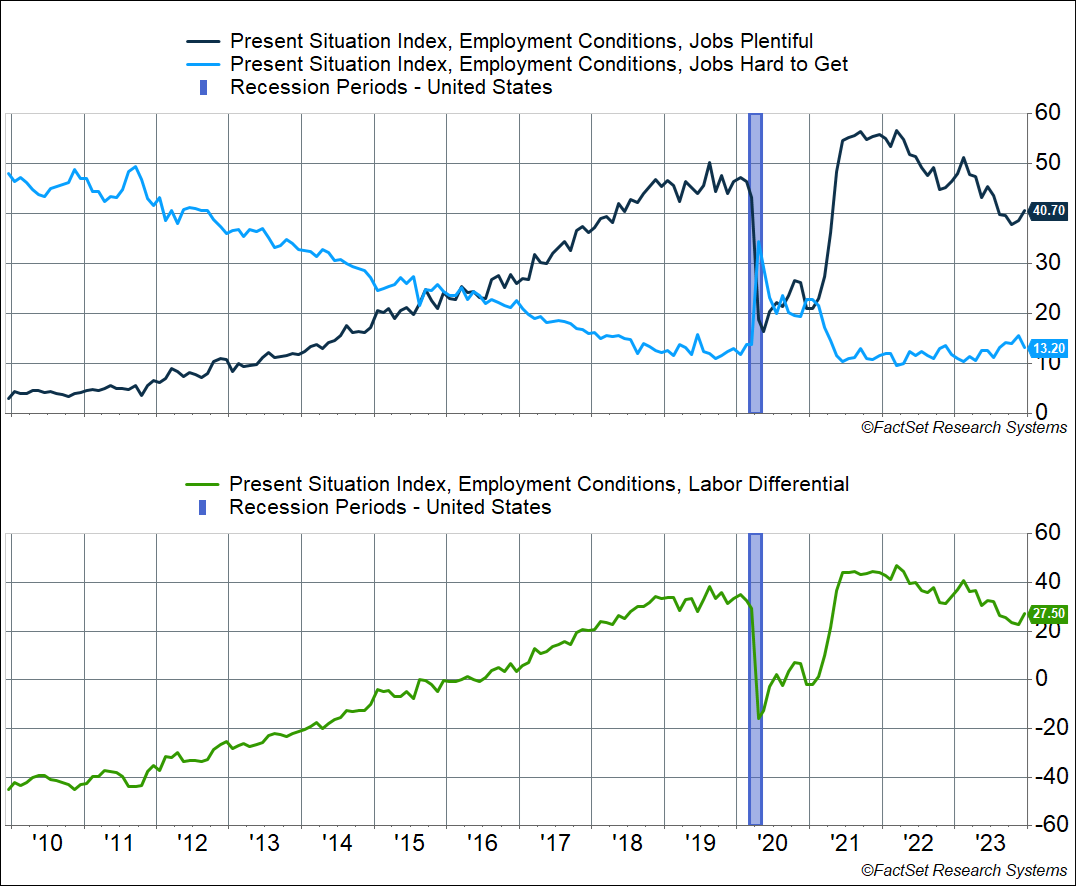

The labor market continues to run strong. Now, the data has shown that the labor market has been strong for a long time now, with the unemployment rate below 4% throughout this year. But perhaps more importantly for confidence, consumers’ perception of the labor market has been improving. From the Conference Board’s consumer survey in December, the percent of respondents saying “jobs are plentiful” rose 2.1 points to 40.7%, while the percent of respondents saying “jobs are hard to get” fell by 2.4 points to 13.2%. The “labor differential,” which is the difference between the two, edged up 4.5 points to 27.5, which is close to what we saw pre-pandemic and means that Americans are feeling good about the labor market.

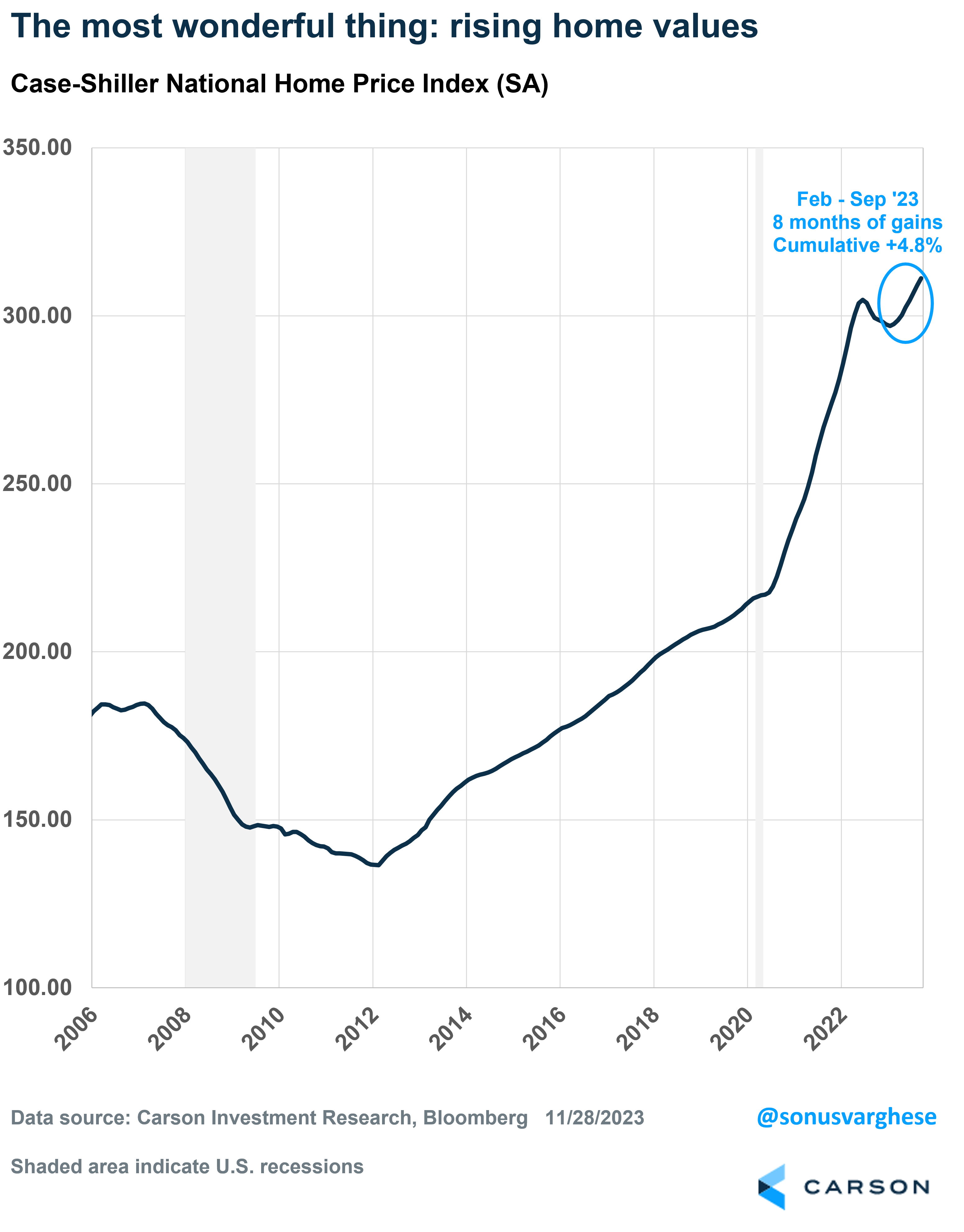

Home prices are rising and are currently at record levels. The Case-Shiller National Home Price Index has been rising for 8 straight months (through September), increasing 3.8% during this period and more than erasing last year’s downturn. For middle income households (25th to 75th percentile), most of their wealth is tied up in their homes, with stock ownership being relatively lower. So rising home prices is a boost to household net worth, and even if households can’t access it due to higher mortgage rates, having a higher net worth is cause for cheer.

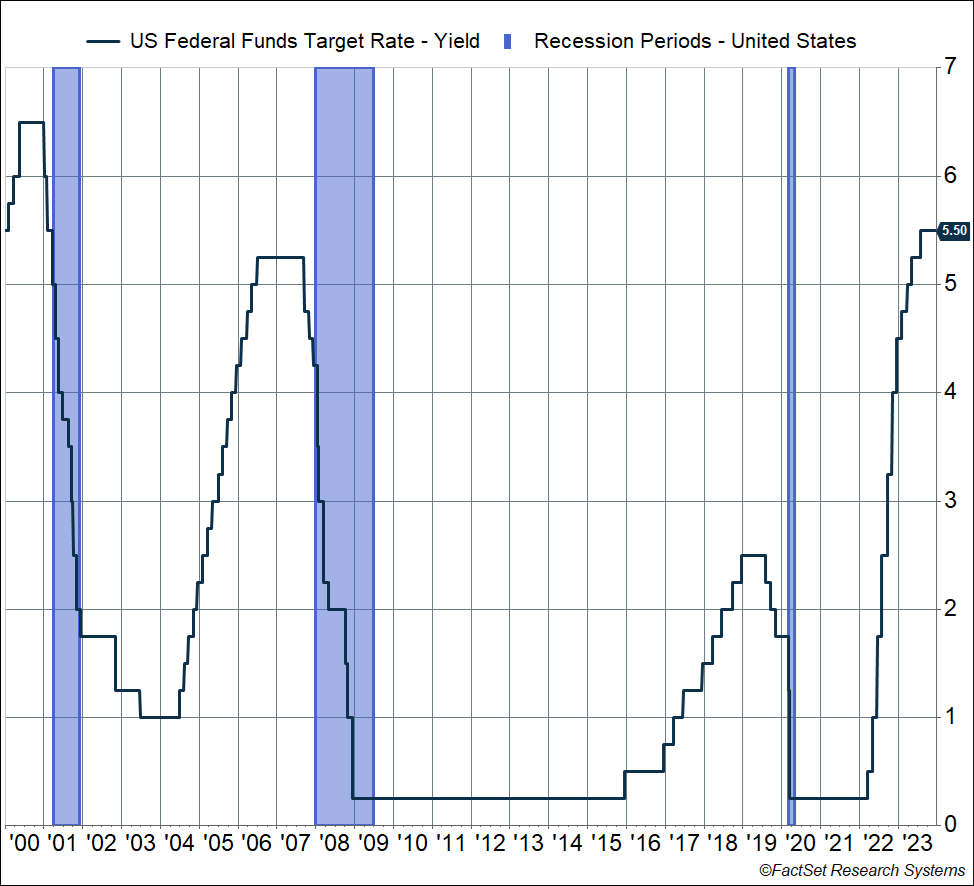

Savers can now get higher rates in savings accounts, CDs, and money market funds. For a decade after the Financial Crisis, a common refrain was that the Fed was “punishing” savers. Well, that’s changed. Thanks to aggressive rate hikes that took the fed funds rate to the 5.25-5.5% range (the highest in 20+ years), savers can earn a lot more on their savings. Of course, enjoy it while it lasts, because rates have probably peaked, and it’s likely the Fed cuts rates by about 1.0% -point next year.

This wonderful cocktail of positive developments for American households is welcome news right around the holidays. Households were already fairly positive about their own finances (also witnessed by their willingness to spend), but now their perception of the broader economy is turning up.

Merry Christmas, everyone!

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

For more of Sonu’s thoughts click here.

2038225-1223-A