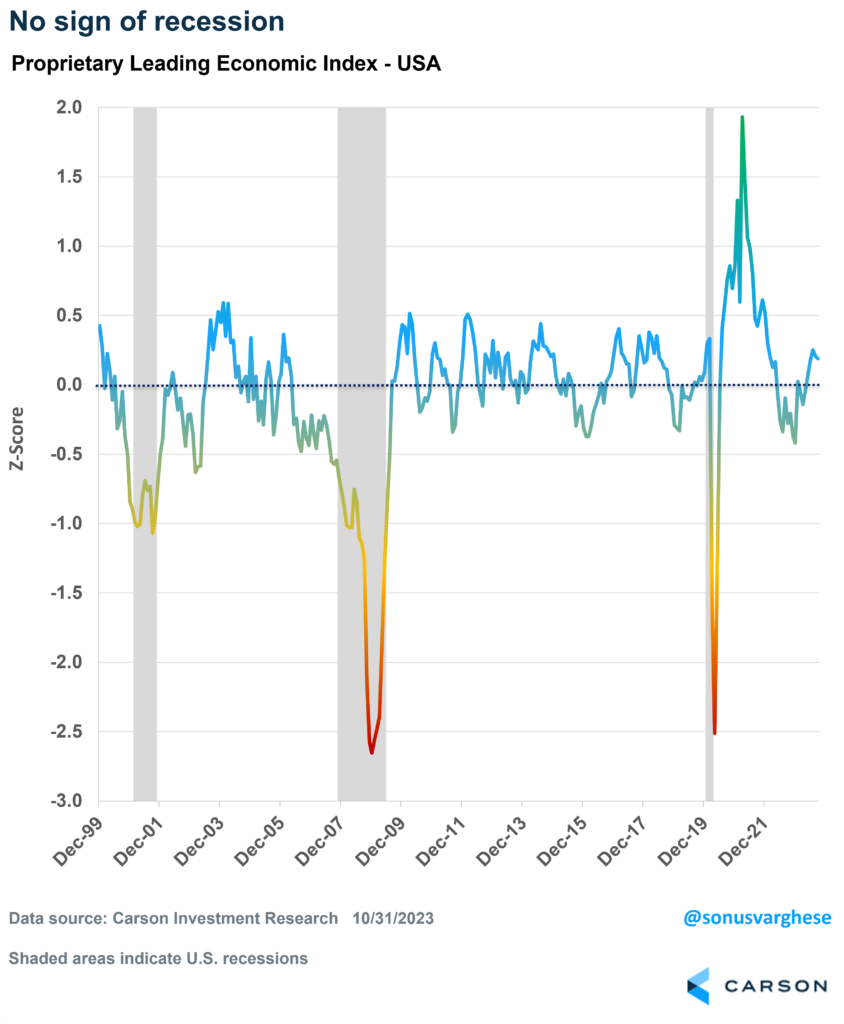

We publicly started releasing our proprietary leading economic index (LEI) in our 2023 Mid-Year Outlook, which we use to give us an early warning signal about economic turning points. We produce an LEI for the US and 29 other countries, each one custom built to capture the dynamics of those economies. The individual country LEIs are also subsequently rolled up to a global index to give us a picture of the global economy. These were all developed more than a decade ago and form a key input into our asset allocation decisions.

Right now, our LEI for the US points to above-trend, or slightly above-trend, economic growth. Far away from a recession.

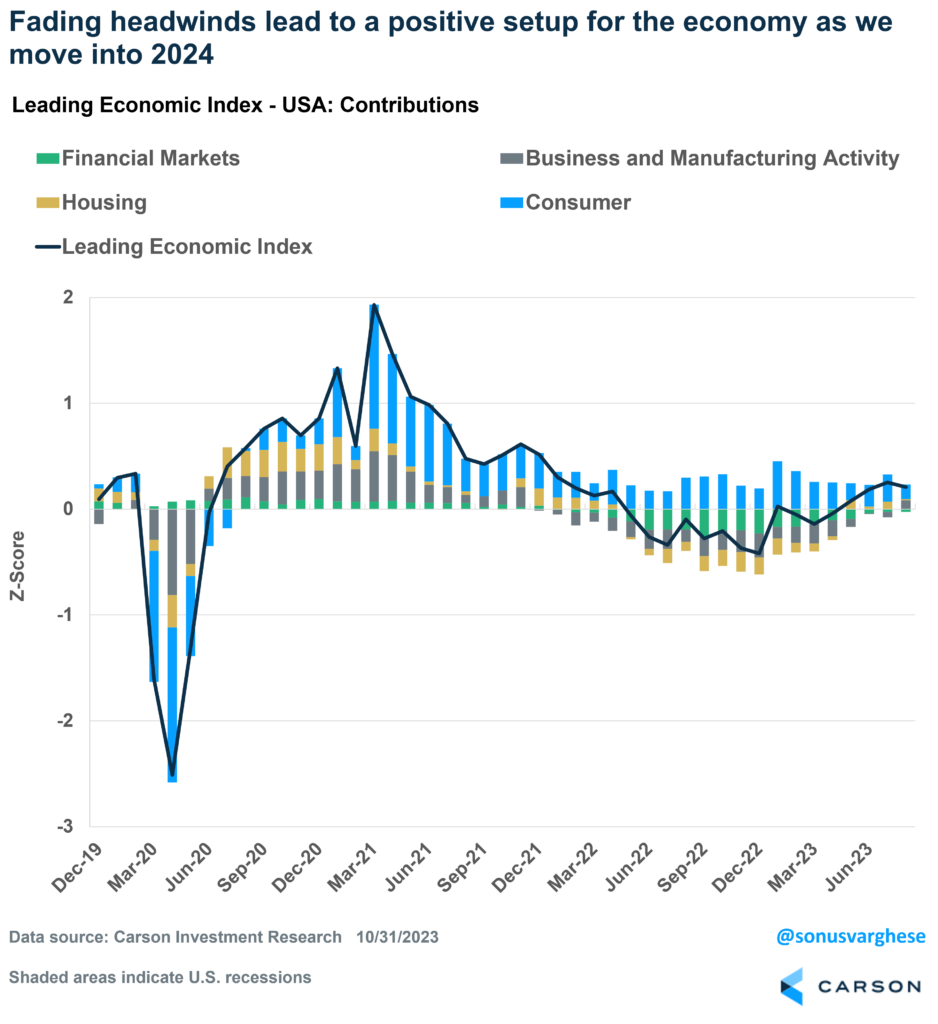

Our index includes 20+ components, including consumer-related indicators (which make up 50% of the index), housing activity, business and manufacturing activity, and sentiment and financial markets. This contrasts with other popular LEIs, which are premised on the fact that the manufacturing sector, and business activity/sentiment, is a leading indicator of the economy. This worked well in the past but is probably not indicative of what’s happening in the economy right now.

The LEI captures whether the economy is growing below trend, on trend (a value close to zero), or above trend. It can capture major turning points in the business cycle. For example, it declined ahead of the actual start of the 2001 and 2008 recessions. Last year, the index signaled that the economy was growing below trend, and that the risk of a recession was high. Note that it didn’t signal a recession, just that the “risk” of one was higher than normal. In fact, our LEI held close to the lows we saw in the prior cycle, especially in 2011 and 2016. In both of those cases, growth slowed (but continued) within a larger expansion. Both times the economy, and even the stock market, went on to recover.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Right now, the situation looks better than it did a year ago.

Breaking our leading economic index for the U.S. into underlying components captures how the economy has evolved since the pandemic hit three years ago. In a nutshell, the consumer has driven the recovery and carried the economy through last year. That’s in the face of major headwinds, mostly driven by a very aggressive Federal Reserve (Fed) – which adversely impacted financial conditions and borrowing costs, housing, and business investment and manufacturing. The good news is that with inflation pulling back, we could potentially see the Fed cutting rates, and that means all those headwinds are fading, and could even become tailwinds in 2024.

As we look toward 2024, let’s take a look at the dynamics that may be in play.

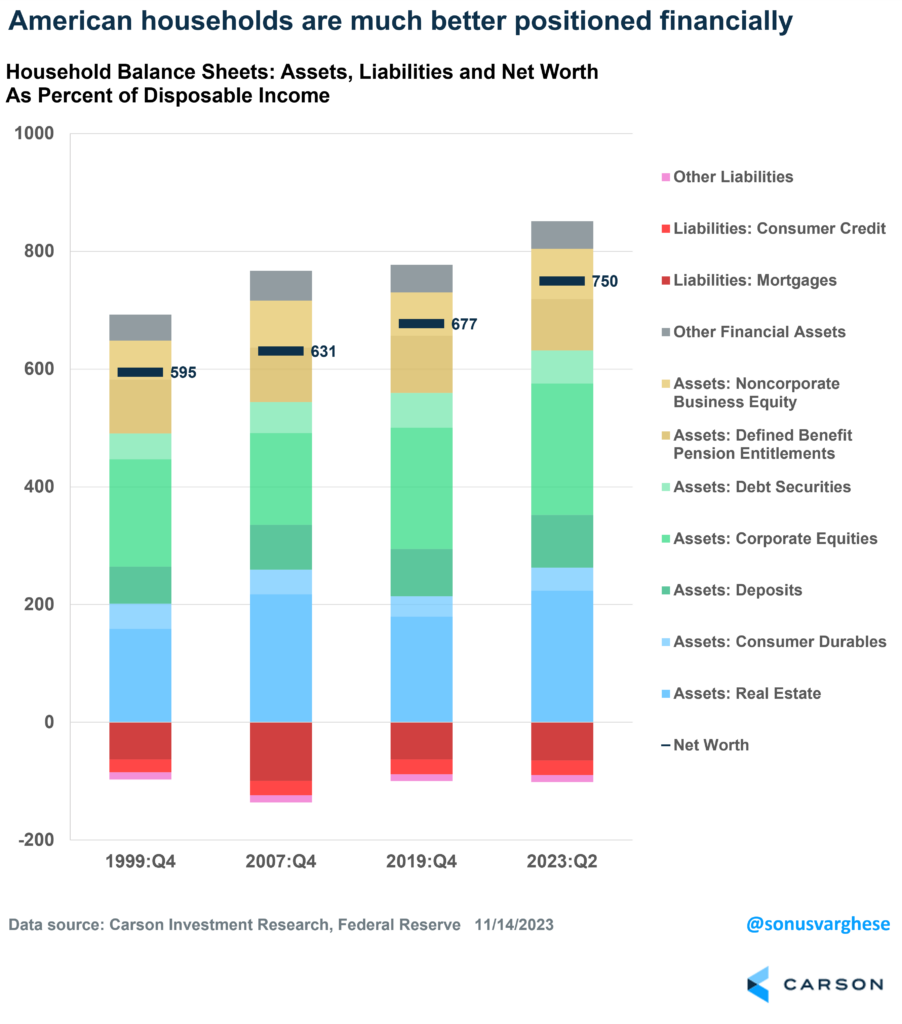

Consumption is likely to remain strong on the back of strong balance sheets.

The good news about falling inflation is that it’s a tailwind for household wallets. Stronger inflation-adjusted incomes will likely power consumption going forward, and thus the economy.

As I pointed out above, consumption has driven growth over the last few years, even in the face of an aggressive Fed, which normally would have resulted in a recession. A big factor was that households had a lot of excess savings that built up during the pandemic. A large portion of that was used up during the inflationary period of 2022 and after, though our estimate is that there’s still $500 billion – $1 trillion left. Nevertheless, consumption has been mostly powered by rising incomes and lower savings rates. It’s not surprising that savings rates have fallen relative to pre-pandemic – a big reason is that households are much wealthier now than they were pre-pandemic, thanks to higher home prices and stock prices. At the same time, the ability to lock in low mortgage rates when interest rates were low means debt hasn’t increased as much as household assets have. Household net worth is now 7.5 times disposable income, much higher than the 6.8 times just before the pandemic. And as the chart shows, it’s entirely because asset values have increased, while liabilities have stayed more or less the same. In fact, liabilities as a percent of disposable income are closer to where they were in the late 1990s (~ 100%), and well below 2007 levels of 136%, when households were a lot more leveraged.

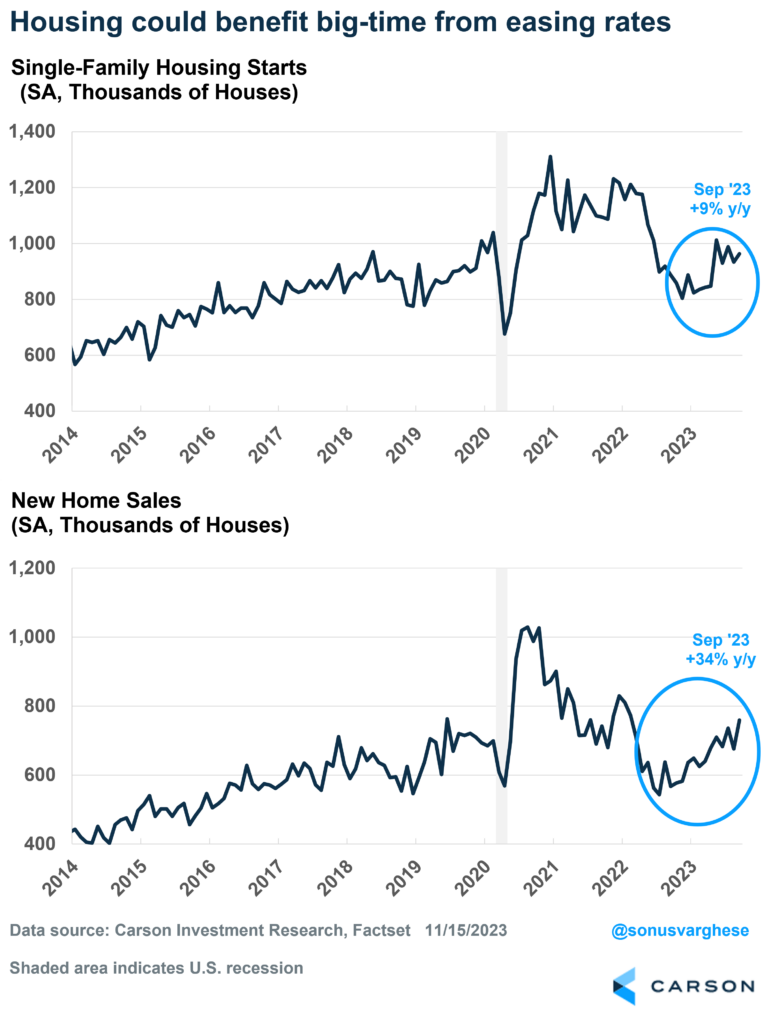

Easing rates should boost cyclical activity.

As I wrote in my prior blog, the soft October CPI report has resulted in a pivot of monetary policy rate expectations. There’s good reason to think inflation is headed lower in a sustainable way, and that means the Fed could potentially make a few rate cuts in 2024, perhaps as early as spring. That’s going to ease borrowing costs.

The immediate beneficiary of lower borrowing costs will be residential investment. We got a preview in 2023 – housing activity, especially on the single-family side (which makes up the largest part of residential investment), picked up as mortgage rates eased early in the year. Things cooled down as mortgage rates surged above 8% in the fall, but we could once again see starts and new home sales pick up as rate ease once again.

It’s very unlikely mortgage rates pull back to the low levels of 2021, but even moving toward 6% could unlock a lot of activity, especially since there’s a lot of pent-up demand. The largest age cohort in America are 25-34 year olds (millennials), and that’s prime home-buying years, which is why housing activity in the new homes market hasn’t collapsed despite higher rates. Single-family starts are up 9% year over year, while new home sales are up 34% year over year. High rates have locked in existing homeowners who don’t want to sell and buy a new home with a higher mortgage. So potential home buyers are looking to the new homes market. Most importantly, new homes contribute more to economic growth because of design, construction, and engineering, in addition to brokers commissions and other transaction costs (which apply to existing homes as well).

The other beneficiary of lower rates will be businesses, especially small businesses who tend to borrow more floating rate debt. That’s going to potentially improve the investment outlook and increase business activity. Business sentiment has been poor for the last couple of years, especially on the manufacturing side. This is despite hard data telling us that manufacturing production increased in 2023 and is running above pre-pandemic levels. A better financing picture will likely improve investment sentiment.

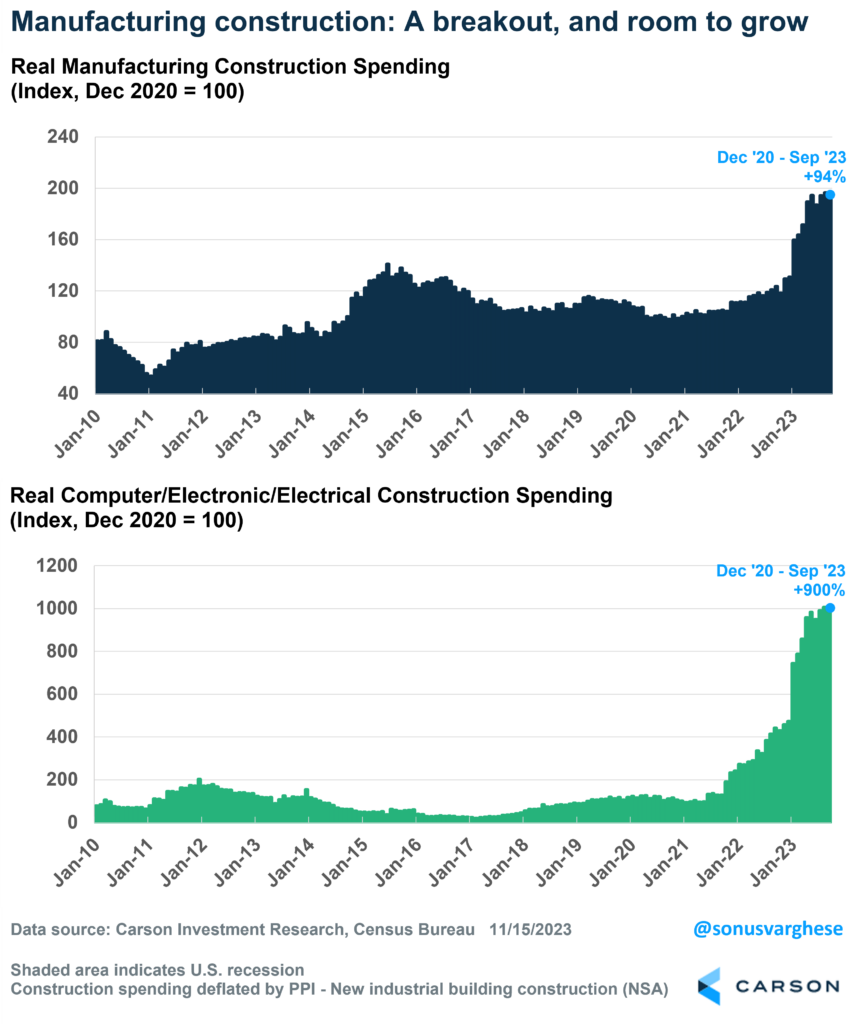

All this is likely to come on top of resurging manufacturing construction activity – which has risen 94% since the end of 2020, after adjusting for inflation. Construction of facilities that manufacture computers, electronic, and electrical equipment, i.e. semiconductor and electric vehicle battery plants, have surged a whopping 900% over the same period. The inflection point came after mid-2022, on the back of the CHIPS and Science Act and the Inflation Reduction Act, which pushed grants and subsidies into reshoring manufacturing facilities. Only a portion of the money authorized by Congress has been released by the Department of Energy, and so there’s plenty more to come. Not to mention additional funds authorized as part of the bipartisan Infrastructure Investment and Jobs Act.

All said and done, the economy looks nicely positioned as we head into 2024, with continued consumer strength and the massive headwind of Fed policy potentially turning into a tailwind, which is why we believe the probability of a recession in 2024 is low, perhaps only around 25%.

Take a listen to the latest Facts vs Feelings episode, where Ryan and I talked about the inflation report, and how that’s shifted the market conversation towards rate cuts in 2024.

For more of Sonu’s thoughts click here: https://www.carsongroup.com/insights/blog/author/svarghese/

01983603-1123-A