The June CPI report was a positive surprise, both in terms of the headline numbers as well as the underlying details.

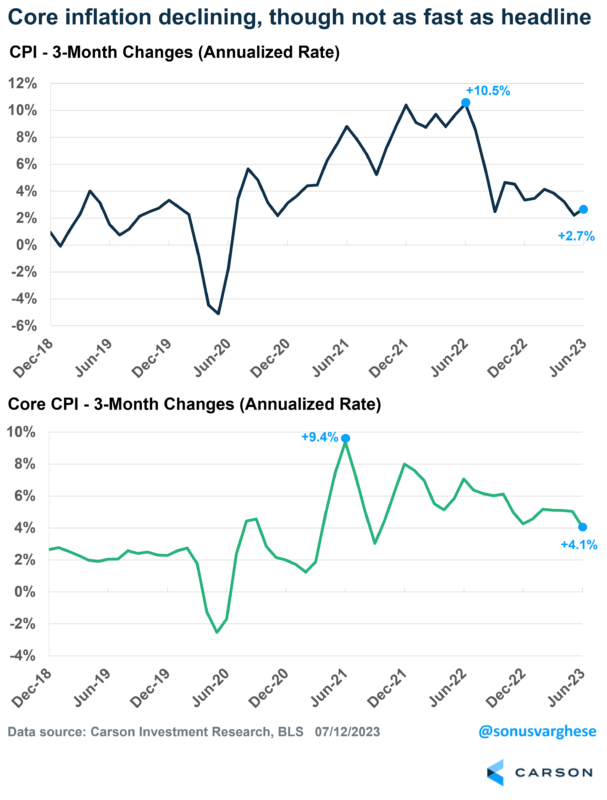

Headline inflation rose 0.2% in June, which translates to a 2.2% annual pace. Over the past three months, inflation’s averaged about 2.7%, and over the last year it’s up 3.0%. That’s well off the peak pace of over 9% exactly a year ago.

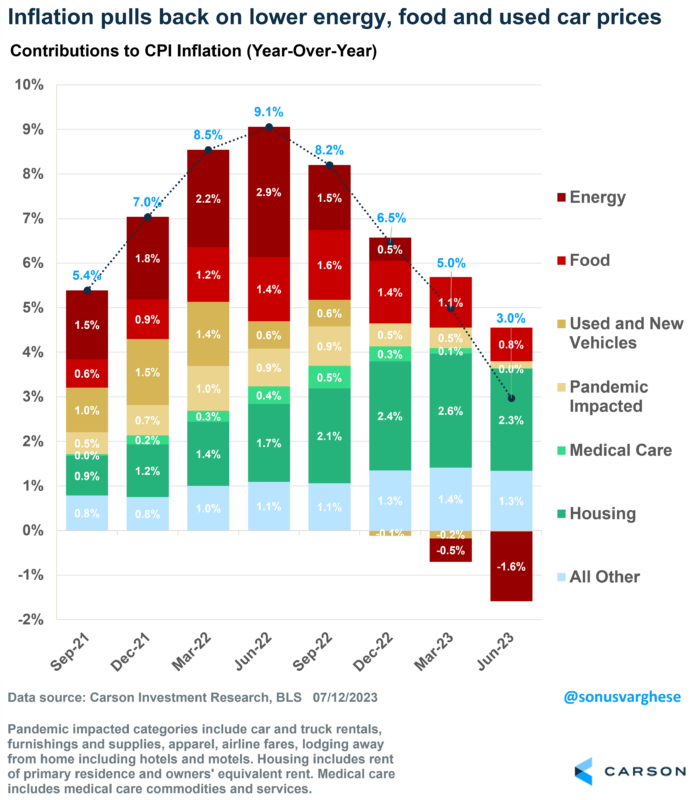

In my opinion, the reason for the decline is obvious when you look at the chart below. Energy prices drove the inflation surge in 2022, especially after Russia’s invasion of Ukraine. Energy prices have now declined 17% over the past year, pulling inflation lower. The good news is that food inflation is also easing a lot, rising at an annual pace of just 1.3% over the past 3 months. Remember the surge in egg prices? Well, egg prices have fallen 21% over the past 3 months.

All this of course has been occurring for a few months now and shouldn’t be a big surprise.

The problem until now was that “core inflation,” i.e., inflation once you strip out energy and food prices, remained elevated. But we got good news on that front.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Core inflation rose just 0.16% in June, which translates to a 1.9% annual pace — the slowest monthly pace since August 2021! That’s great, but as you can see below, the 3-month pace remains above 4%. So, we’ve yet to see a consistent deceleration in core inflation, which is what the Federal Reserve is looking for.

Positive signs

We realize that one month does not make a trend, but a lot of the underlying details point to downward momentum. Let’s look at a few of these.

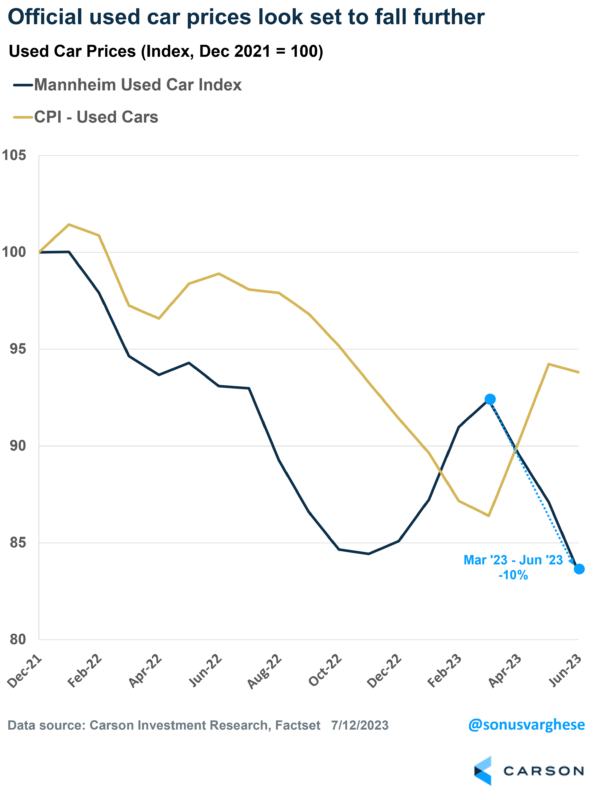

Used and new vehicle prices, which make up 9% of the core inflation “basket,” have reversed a lot over the past year. However, used car prices rose in April and May, reversing some of that momentum. But things look to have turned around once again, with used car prices falling 0.5% in June. In fact, prices are likely to fall further over the next few months based on private used car auction data (Ryan pointed this out in his previous blog as well).

Moreover, the auto production supply chain bottlenecks are being resolved, and therefore we’re seeing vehicle production increase. As a result, prices for new vehicles have fallen about 0.4% over the past three months, and that downtrend is likely to continue given increased supply.

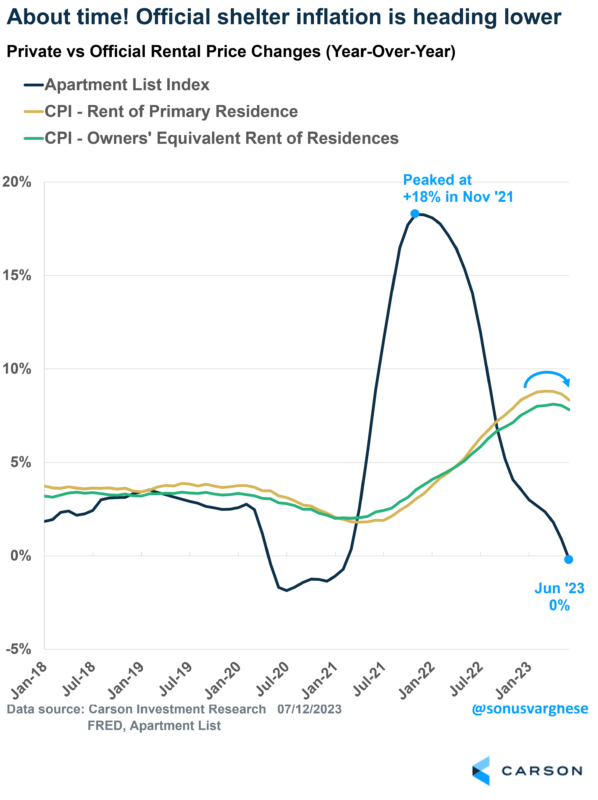

The big one is housing inflation, which Ryan and I have been talking a lot about over the past year. Housing makes up 40% of core inflation, but importantly, it does not include home prices. Instead, it’s based on rents. The problem is that there is a significant lag between official rental inflation and private rents data. Private data from Apartment List shows that rents have decelerated from a peak of 18% year-over-year pace to zero as of June! Official data lags this data by about 12 months or so and it’s taken a while to reflect market reality.

The good news is that official rental inflation appears to be turning lower. Rental inflation was averaging a 9% annual pace between June 2022 and February 2023. However, that’s fallen to about 6% over the past 4 months. That’s still higher than the 2018-2019 average of about 3-3.5%. But given what we’re seeing in market rents, we expect housing inflation to continue decelerating and that’s going to pull core inflation down in a big way later this year and into 2024 as well.

What about the rest?

Fed Chair Powell has cited “core services ex housing” as still being elevated. We believe it’s their way of saying,

“Yes, we see vehicle prices heading lower, and acknowledge the lags in housing inflation data; but we want to see the rest of it fall”

But there’s good news on that front too.

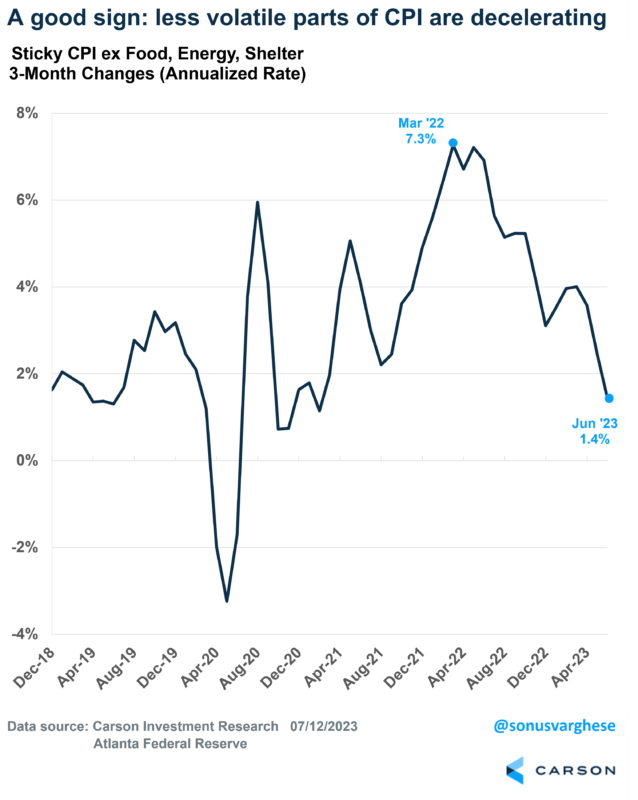

The Atlanta Federal Reserve calculates something called the “Sticky Price CPI excluding food, energy, and shelter.” Simply put, it measures inflation for items whose prices typically don’t change frequently.

In June, this sticky price measure was flat. Over the past 3 months it’s running at a 1.4% annual pace, well below the peak of 7.3% we saw 15 months ago. A key piece of this is restaurant food prices, which have slowed down a lot recently on the back of falling food prices. But even things like airfares, daycare and pet care services inflation have been falling.

You can see why the June inflation report was positive from so many angles. A low reading is positive by itself, but it also confirmed what we know from other sources about what to expect going forward.

Perhaps the best news is that inflation is falling, and poised to fall even further, without a rise in unemployment and an economic slowdown. A year ago, Federal Reserve officials and many economists were saying that we probably need to go into a recession for inflation to slow down, and that aggressive rate hikes by the Fed would push us into one.

Instead, the unemployment rate is at 3.6%, close to 50-year lows. If real GDP growth clocks in around 2% for last quarter (as seems likely), that would mean the economy’s grown at a 2.5% pace over the past year. While inflation’s fallen from 9% to 3%. That’s huge!

1832881-0723-A