Often there is a difference between what advisors believe about their firm and what the numbers say. Even as performance driven as our industry is, advisors can be reluctant to open the cover and turn the pages of the book that describes their operating results.

But these numbers, these performance measurements, are simply feedback. They describe what’s working well and what needs improvement. Numbers are not inherently good or bad, they’re a neutral conveyance of information – much like the speedometer in your shiny new sports car, the scale in your bathroom, the number of likes on your most recent social media post, or the cholesterol reading at your last physical. (Wait a minute, am I dating myself?)

Key performance indicators are a form of feedback – the consequences of choices made and paths traveled. We elect to add the emotional spin, whether it’s elation at numbers that exceed expectations or disappointment and even shame at those that do not.

It’s worth fighting through any discomfort you might feel in looking at this data or reluctance at putting in the effort to collect it. Performance measurement allows a greater understanding of firm strengths and weaknesses, gives leaders more control over revenue, profitability, and the utilization of resources, and guides the way to course corrections if and when they are needed. KPIs are tools that can help you convert the firm you dream about into the firm you experience each day.

So, I’m inviting you to adopt a new attitude toward your financials. It is now officially a judgment-free zone.

Below I’ve outlined three approaches to getting into the driver’s seat on the assessment of your business performance, starting with a very simple approach and moving on to more detailed methods that, while more time-consuming, are far more informative about your firm’s financial vitality and your progress toward the achievements that matter most.

We’ve all heard that what gets measured gets managed, so take a spin through each suggestion and identify the method that best aligns with your desire for financial clarity and data-driven management.

After describing the separate methods, I offer some practical suggestions for incorporating these ideas into your leadership workstreams.

Level One KPI: Net New Assets

This first level involves tracking just one metric: net new assets. NNA is the single most important financial metric in the Carson ecosystem. It’s a heat-seeking missile in search of the genuine tally of firm growth. It is the sum of assets from new clients and supplemental assets from existing clients, minus the sum of transfers out, systematic distributions, and fees.

When advisors choose not to focus on genuine growth statistics like NNA, things can get a little fuzzy. Below are two anecdotes illustrating how a tenuous grasp on metrics can lead one astray, or at least hide challenges or problems that can grow and become more serious over time.

During a coaching call a couple of years ago I asked the advisor how business was going. He said “Things are great! We’re up about 15% this year.” Knowing that he had been experiencing long-term business development challenges, I asked how much of that growth was due to market appreciation. He paused for a moment and said, “Uh, well..all of it.” To me, that was a simple admission that he had experienced no real growth at all – zero new assets and no new relationships. What if the markets had gone down 20%? The advisor would have seen his business diminish significantly and would have just experienced a 20% pay cut. Is that acceptable?

Another advisor has an older clientele with a high level of systematic distributions. Clients are spending down their assets to pay for their retirement lifestyle – by design. But the result is a 6% annual drawdown in the advisor’s book. If you add 1% on top of that for fees, the advisor must add 7% in new assets each year just to break even.

Again, a booming market hides all manner of problems like these. But otherwise, the challenges only compound.

If you’re going to track just one statistic, strongly consider net new assets. It highlights meaningful growth information – the aggregate direction of asset flows, and removes the illusory effect of market appreciation.

Level Two KPIs: A Broad Mix of Measurements

The next approach involves a group of KPIs collected by the Carson coaches. These metrics are used regularly by some of our most successful firms. They measure disparate elements of the business, and collectively, describe the relative financial health of the organization, how effectively resources are deployed, and the degree to which strategies for new client acquisition are bearing fruit.

This list may be more comprehensive than some will prefer, but hopefully it will get you thinking about what’s going on behind the scenes and what lies underneath the popular “we’re up x% this year” statement.

Think of it as a picklist and take note of the measurements that are most meaningful to you. What information will most powerfully enable you to guide the ship from where it is now to where you want it to be?

Suggested Metrics:

- Investment Management Revenue

- Insurance Revenue

- Total Gross Revenue

- Total AUM Advisory

- Total AUM Brokerage

- Total AUM All

- Number of Households

- Assets from New Clients

- New Assets from Existing Clients

- Outflows (systematic distributions, transfers, fees)

- Net New Assets

- Referrals from Clients

- Referrals from Accountants

- Referrals from Attorneys

- Referrals from Other Sources

- Total Referrals

- Referrals Converted to Clients

- Advisory Revenue Percentage

- Profit Margin

- Gross Revenue per Team Member

- Break-Even Point – Advisory

Level Three KPIs: Value Drivers

If you’re ready to play varsity ball, the valuation approach to KPI management has your name on it. This method piggybacks off your recently completed firm valuation and tracks the key value drivers that either add to or subtract from your valuation number.

Read more: How to Determine What Your Advisory Business is Worth and Improve Your Firm’s Valuation

Some of the many levers that impact valuation are:

- Client Tenure

- Client Addition and Departure Rates

- Average Client Age

- Growth Trends

- AUM per Advisor

- Number of Households per Advisor

- Percent of AUM with a Next-generation Relationship

We recommend that advisors maintain a constant vigilance posture regarding firm value. Those who actively manage value drivers not only optimize the price of what is likely their largest personal asset, but also maximize profits because of the link between greater value and greater revenue. It sounds like a compelling two-for!

If you don’t have a recent valuation, hire an M&A or valuation consultant experienced with our industry to perform one. Once completed, study the list of characteristics that impact your number and highlight the underperformers that exert downward pressure. This will become the basis of your KPI management.

How to Bring the Data to Life

Regardless of the method you choose – and please choose one! – it will only make an impact if you put a plan in place to regularly collect, report on, and assess the information, and then implement strategies to move the numbers that are not where you want them to be. Consistency and accountability are key to making it work.

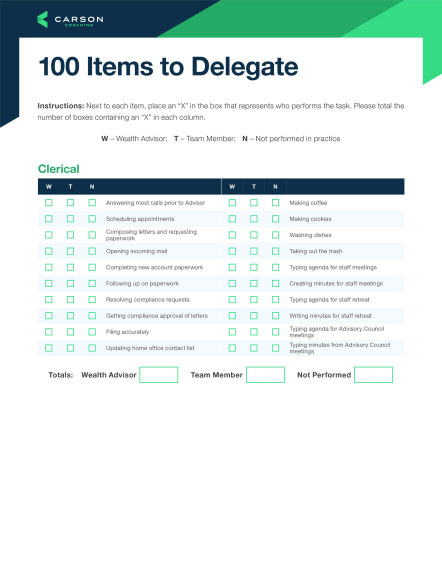

This data rustling activity is probably not a strong suit for most advisors nor the best use of a senior wealth advisor’s time, so delegate the task to a trusted team member who has the capability, capacity, and desire to do that work.

Develop a cadence for reviewing this all-important information. Quarterly sounds about right. You’ll want to capture and store the data as it changes over time so that you can analyze trends and determine if you’re on track to surpass annual targets.

Determine who among your leadership team should be included in these evaluation and planning sessions. Advisors are often cautious about sharing financials with team members – and rightfully so. But consider whether giving key personnel a peek under the hood can help inspire greater focus and discipline. If stakeholders know what’s driving firm success with clarity and detail, are they not better prepared to effect the right change in the right way?

Peace With The Current State and Resolve to Improve

I encourage you to regularly review results for the benchmarks you have selected. Find the data points that suit you and appropriately measure the financial health and success of your business. Find inspiration in positive outcomes, and for results that miss the mark, be peaceful with this temporary state and resolve to take action that will move the numbers to where you want them.

The stats are just communicating the current state. With awareness and will you can change it.

Learn how to grow your advisory firm, your team and your bottom line with Carson Coaching. Click here to schedule a complimentary consultation.