“AI is the most profound technology that humanity will ever develop and work on. [More profound] than fire or electricity or the internet.”

– Sundar Pichai, Google CEO

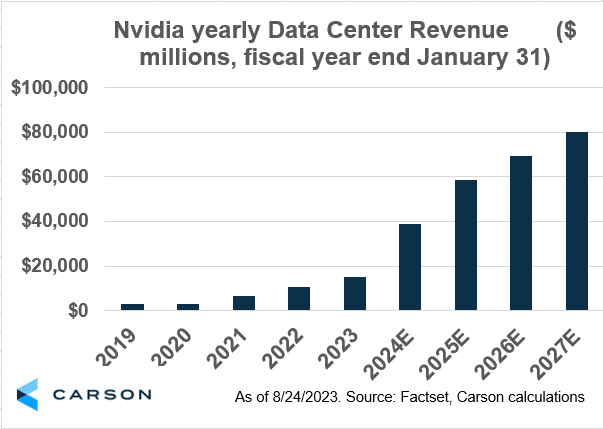

Nvidia’s much-anticipated second quarter earnings surged past lofty expectations by 30%, propelling shares to a new all-time high. The heartening aspect of the report for investors is the indication of a sustained trend rather than a one-time spike in orders. Adding to this momentum, the guidance for the third-quarter surpassed analyst’s forecasts by a substantial margin. Nvidia expects to generate $16 billion in sales in the third quarter vs expectations for roughly $12.5 billion. To top it off, management announced a new $25 billion share repurchase authorization.

The company has been in the spotlight as its chips are at the epicenter of the Artificial Intelligence (AI) revolution. Nvidia’s processor chips are ushering in a breakthrough in computing that evokes parallels to the dawn of the internet. Its powerful chips are considered the gold-standard for AI and represent the culmination of decades of innovation. In the wake of a market downturn that spanned much of 2022, an AI frenzy ignited the impressive rally we’ve witnessed thus far in 2023. While initial perception suggested AI was potentially overhyped, Nvidia is shattering such notions, progressively affirming the immensity of AI with each consecutive quarter. Tech giants, Amazon, Google, Meta, and Microsoft among them, are voraciously adopting Nvidia’s chips to power data centers that underpin applications in AI and cloud-based computing. This potentially bodes well for the heavily weighted technology sector, but it could also be the start of the largest secular trend that will impact every facet of the economy over coming years.

AI’s impact extends far beyond Nvidia, management noted that demand is “tremendous” and “virtually every industry can benefit from generative AI.” Even within agriculture, farmers are leveraging AI to monitor crops and optimize input usage. Remarkably, AI can identify incipient weeds among crops, detecting them at sizes as miniscule as half a sesame seed. The remarkable precision of this technology facilitates pinpoint herbicide application that reduces chemical usage by up to 90%.1 In the energy sector, electric companies employ AI to anticipate energy demand and optimize distribution, significantly curbing wastage. This is only the beginning; the true potential of artificial intelligence remains largely unexplored. Much like the internet’s humble beginnings, when email and browsing were becoming the norm the immense capabilities of smartphones we carry today were inconceivable. It’s expected to revolutionize productivity for businesses and workers alike, this ongoing compute revolution promises substantial transformation and disruption. It could also potentially fuel a new era of growth for both equities and the global economy over coming decades.

Nvidia’s shares have skyrocketed more than threefold year-to-date, propelling its valuation beyond the $1 trillion mark. This ascent is a testament to its central role in the generation defining era of AI. While the historical valuation appears astronomical, investors are shifting their focus to the future and trying to wrap their arms around the enormity of this transformative shift. Forecasts point to Nvidia’s high-margin Data Center business surging to $80 billion in sales over the next few years. Based on the accuracy of recent analyst projections, these forecasts might ultimately prove too conservative. It’s certainly not a bargain, but with each data point it seems more and more likely that it can live up to the hype.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields