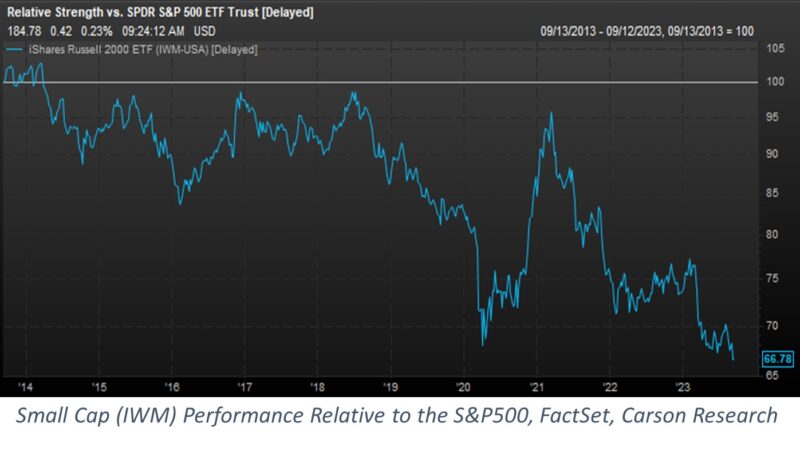

Small cap stocks have dramatically underperformed large caps year-to-date. This isn’t a recent phenomenon. Small caps have lived in the shadows of their largest peers, particularly mega cap technology companies, for nearly a decade. The lag has worsened over recent years as inflation picked up and equity indices have become even more concentrated at the top. It’s a trend that many have noticed, and it’s left investors wondering if small caps will ever make a comeback. We believe the outlook for smaller companies is improving as inflation ebbs and earnings growth accelerates. With small-cap valuations at historic lows, relative to large caps, we might be on the verge of a small cap rally. Our House View recommends overweighting small cap equities into the back half of the year.

Small-cap stocks have enjoyed a longstanding reputation for outperforming large caps over long periods of time. It’s an idea that gained traction when financial luminaries Eugene Fama and Kenneth French introduced the concept of the “small-cap factor” in their statistical model during the early 1990s. If we rewind the clock, going back to 1927, it does indeed appear that small-cap stocks have tended to generate higher returns over time. However, during the past thirty years, the small-cap premium seems to have diminished. This shift in reality serves as a stark reminder that academic theories often look to the past for validation, but the real world of equity investing requires a forward-looking perspective. Conventional factors that were once considered gospel, such as value and small-cap superiority, no longer appear to hold the same explanatory power they once did over the course of the previous century. That said, regardless of the diminished value of the small factor, the opportunity does appear ripe to allocate to small caps.

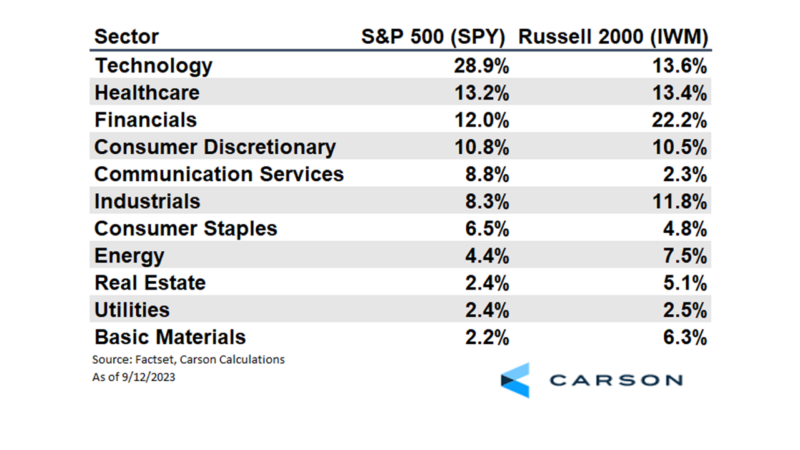

Examining the underperformance of small caps more recently reveals a fascinating story of sector dynamics. The large cap index (S&P 500) is dominated by the technology sector with a 29% weighting. In contrast, the small cap index (Russell 2000) sports a robust 22% allocation to financials. Over the past five years, large cap technology stocks have more than doubled while small cap financials have declined. There is more to the sector narrative than these notable outliers. Small cap stocks tend to be more cyclical because of higher allocations to capital-intensive industries like Energy, Materials, and Financials. This sensitivity to economic ups and downs means that small caps often shine when the world emerges from recession, like we witnessed in late 2020 as the US reopened. This trend was soon overshadowed by the emergence of next-generation computing. Call it the digital economy, the stay-at-home trade, metaverse, and most recently artificial intelligence, investors are betting the future growth of the economy is digital. Not only does this play into large cap’s greater technology exposure, but the nature of these new technologies overwhelmingly favors massive scale. With the large cap technology sector roaring nearly 40% year-to-date, and small caps have risen a mere 7%, we think this viewpoint is already reflected in market prices.

Inflation also plays a role. Smaller companies often lack the pricing power enjoyed by larger companies, which makes it more difficult to pass on the burden of rising costs to consumers. To illustrate the point, let’s contrast two examples. Tech giant Microsoft doesn’t feel the same impact from rising costs because of its asset-light business model, and it benefits from the substantial pricing power of its proprietary software. Compare that to Helmerich & Payne, an oilfield equipment provider. Here, rapidly rising costs became a formidable challenge, but the company enjoys limited pricing power as it competes with many regional players. While Helmerich & Payne acutely felt the margin squeeze, Microsoft was growing more profitable. Now, as the tide of inflation gradually recedes and businesses inch their way back to a more normal operating environment, small cap stocks are poised for a comeback.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Several factors are converging to set the stage for this small cap rally. With inflation gradually loosening its grip on companies, small cap margins are expected to expand; potentially fueling accelerated earnings growth in the years ahead. Valuation differentials are at historic lows, not since the Tech Bubble in 2000 and the Great Financial Crisis in 2008 have small caps traded at such a discount to large caps. Looking back, small caps have delivered impressive outperformance following such valuation differential extremes. While we do appreciate that the small cap premium originally described in the 90’s hasn’t been as persistent over the past thirty years, the stars may be aligning for a small cap rally.

1902152-0923-A