We have consistently emphasized this year that our House View – a strong consumer base powers a resilient economy – continues to resonate in both the broader stock market and economic indicators. As we sharpen our pencils, though, we’ve discerned shifts in consumer preferences. The consumer appears undeterred by inflated prices for everyday indulgences, such as a latte or a candy bar, but is becoming more scrupulous with larger purchases, like an iPhone. The shift from goods during the pandemic to services post-pandemic endures. This was evidenced in the sustained demand for travel and events during the third quarter. While the outlook for economic growth continues to cool, consumer spending will probably remain near these levels as long as employment and payrolls remain robust.

Last week, all eyes were on Apple’s fiscal fourth quarter earnings report. With its products boasting a comma in their price tag, investors were cautious heading into the print. Adding to the apprehension, a flurry of headlines out of China throughout the quarter indicated increasing competition from Huawei and a government ban on US technology in certain workplaces. Despite these challenges, the iPhone performed slightly better than expected and achieved a quarterly sales record both globally and in China.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

Tim Cook’s outlook for sales in the upcoming holiday quarter, similar to last year, fell short of expectations for a rebound in growth and did little to assuage investor concerns about iPhone demand. Yet, despite all the focus on being the fourth consecutive quarter of sales declines, shares barely budged. This is because the underlying growth trend is heading in the right direction. Apple Services, with revenue growing 16%, has helped mute these hardware headwinds. This high-margin segment, which includes subscriptions such as Apple Music and Apple TV+, has helped push Apple’s operating margin higher for many years, a move that investors have cheered. We expect the company will return to growth in 2024, which bodes well for Apple’s stock.

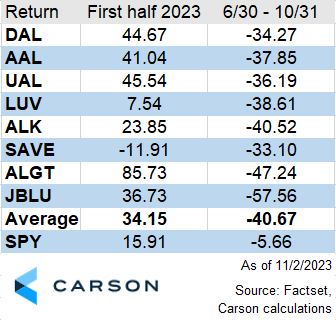

The surge in post-pandemic services spending has carried on with a seemingly insatiable demand for travel. Airlines were the major beneficiaries in the first half of the year, particularly international carriers such as United Airlines, Delta, and American, whose stocks were all up more than 40%. Many carriers reported revenue that topped 2019 levels for the first time and enjoyed a healthy jump in profitability. Though, as fuel prices have risen and many carriers renegotiated pilots’ contracts, the second half of the year is proving to be quite the opposite. With airlines facing an uphill battle to control costs, the stocks have given up all their earlier gains. That said, travel demand remains strong and as airlines absorb the higher wages it pays pilots, it sets up for greater stability in 2024.

While the headlines may seem gloomy, what we’ve heard during this earnings season is consumer spending remains bright. Whether Apple’s Services or travel services, consumers have not satiated themselves yet. We are monitoring the changing preferences in demand, and while demand may shift from one category to another, we have not seen anything to suggest that aggregate demand is wavering. As we navigate these uncertain times, one thing remains clear: the strong consumer is powering this economy. Albeit at a slower pace, we expect this strength to persist into the coming year.

1969033-1123-A