A year ago, a Bloomberg Economics model projected a recession within the next 12 months with 100% probability. That’s a right, a recession was all but certain. Well, fast forward 12 months and not only did we not have a recession, but economic growth has accelerated over the past quarter and is showing strong momentum as we head into 2024.

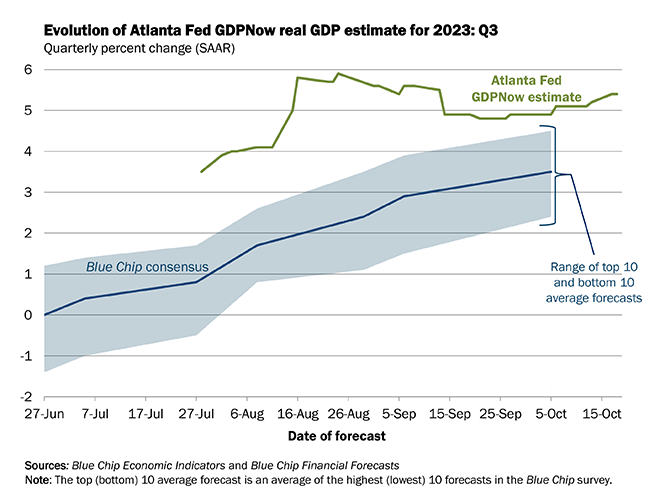

Through June 2023, the economy grew 2.4% after adjusting for inflation, matching the average annual pace we saw between 2010 and 2019. Since then, the economy has accelerated. The Atlanta Fed GDP Nowcast is projecting 5.4% real growth in Q3. What’s amazing is that the “blue chip consensus” showed that economists on average expected zero growth in Q3 back in June, which means several of them even expected the economy to contract.

We have consistently been in the camp that the economy is resilient and will avoid a recession, but at this point, it’s time to call a spade a spade: the economy is not just resilient, its running hot. Now it’s unlikely to run at anything close to 5% going forward, but even half of that is pretty good considering the massive headwind of unprecedented rate hikes by the Federal Reserve (Fed).

The September retail and food services sales data underlined the economy’s momentum. Overall retail sales and food services rose at an annualized pace of 8.6% in the third quarter (Q3). Here’s two data points that neatly captured the strength across both goods and services in Q3:

- Online spending rose at a 12.3% annualized pace

- Restaurant and bar sales rose at 9.6% annualized pace

It wasn’t just about inflation either. Excluding shelter, the consumer price index for all other items increased at an annual pace of 2.7% in Q3. After adjusting for inflation, retail and food service sales were up 5.7% in Q3. Compare that to the 2018-2019 pace of 1.7% per year.

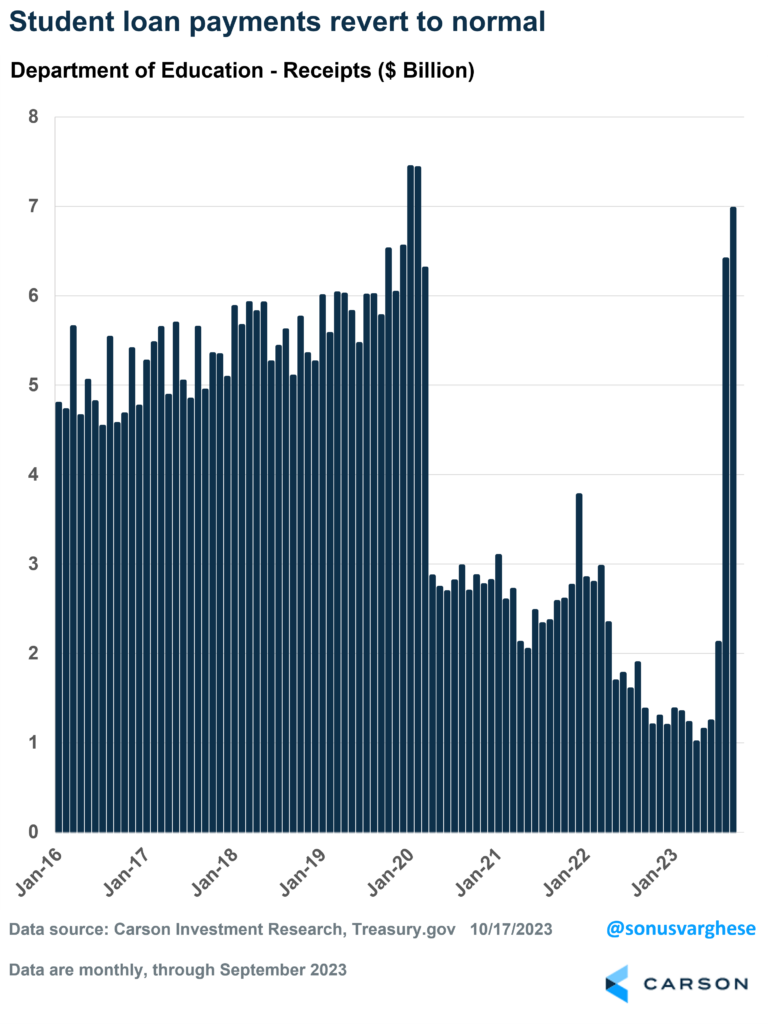

By the way, the consumption numbers I quoted above came amidst surging student loan payments. I’ve written in the past about how we thought it unlikely that the restart of student loan payments would cause a serious dent in the economy. Payments officially restarted in October, but borrowers clearly looked to get ahead of it. Department of Education receipts saw payments jump from an average of $1.2 billion per month over the first 6 months of the year to $2.1 billion in July, $6.4 billion in August, and $7 billion in September. The last two months have exceeded the monthly average of $6 billion we saw in 2019. In fact, the New York Fed analyzed a survey that included student loan borrowers, and found that payment resumption would have only a small 0.1%-point impact on consumption relative to August. A lot of borrowers expected to enroll in new, more generous, income-driven repayment plans. Several borrowers also began adjusting their savings and consumption decisions after learning that payments would resume. It doesn’t look like any of this has adversely impacted consumption in a significant way.

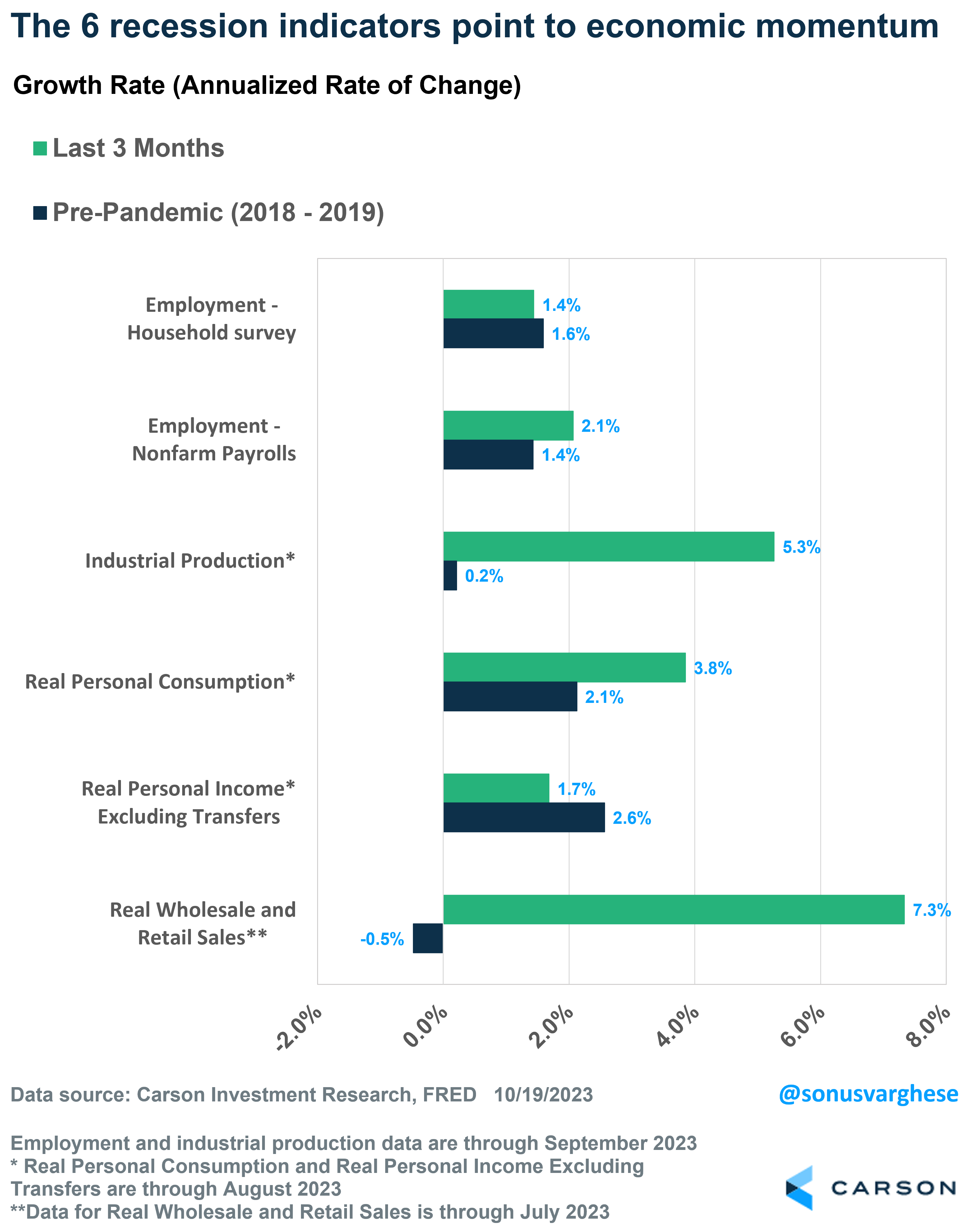

The 6 Economic Horsemen Don’t Point to Recession

The official arbiter of recessions in America, the “Recession Dating Committee” from the National Bureau of Economic Research (NBER), uses 6 economic indicators to decide whether the economy is (or was) in a recession. To make that call, they look for broad-based declines across the labor market, incomes, consumption, industry, and sales. These include:

- Employment: both using the nonfarm payroll version (where the monthly jobs number comes from) and the household survey version (where the unemployment rate comes from)

- Real personal consumption expenditures, which is spending adjusted for prices

- Real personal income excluding transfers, which is income adjusted for prices

- Industrial production, which is a measure of the real amount of production in the economy, especially manufacturing

- Real wholesale and retail sales, which are sales of goods adjusted for prices

As you can see in the chart below, not only are all these measures growing over the last three months, most of them are also running ahead of what we saw before the pandemic. Even the manufacturing sector (within industrial production) is in an uptrend recently. Real incomes have been hit recently by the pickup in gas prices (through August), but the good news is that prices have been falling since then – which will be another tailwind for households.

As you can see, we’re clearly not in a recession and economic momentum suggests we’re unlikely to be in one over the next 3-6 months. Twelve months from now is a long time, but even then, the odds of a recession seem low given the reasons for which we seem to have avoided a recession are still in play, namely strong household, and business balance sheets. Throw in higher fiscal spending directed towards the manufacturing industry and we shouldn’t really be surprised that the economy is strong.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

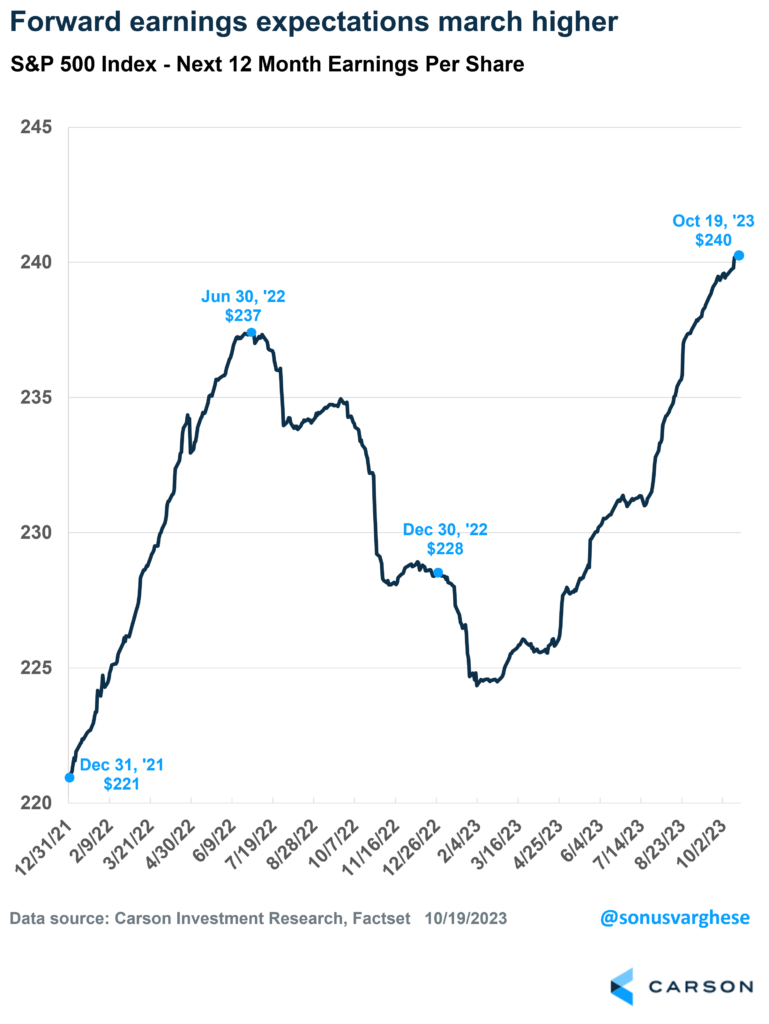

Yes, interest rates are rising but we believe this is because the market is pricing in a stronger economy in the future. Which means the Fed is going to have to keep rates higher for longer. The market’s currently treating that as bad news but at the end of the day, a stronger economy translates to greater profits. In fact, 12-month forward earnings estimates for the S&P 500 continue to hit new highs.

Ryan and I chatted about all this in our latest Facts vs feelings episode, in which we also got to chat with a Carson partner and financial advisor, Matt Gomoll, about the current Middle East crisis. Matt’s served multiple tours in the Middle East as part of special forces and it was great to get his geopolitical perspective. Take a listen:

1944157-1023-A