With many people on the road to visit family or preparing to host, we thought we would do a simple blog today on markets to be thankful for. We put a little wrinkle in it, though, by looking at how far different indexes are from their high and their low dating back to the start of 2022 (as of market close on Monday, November 20). As always, keep in mind that this is past performance and is a review of where we’ve been and not a forecast of where we are going. For more things to be thankful for in the current market environment, see Ryan’s insightful blog posted yesterday.

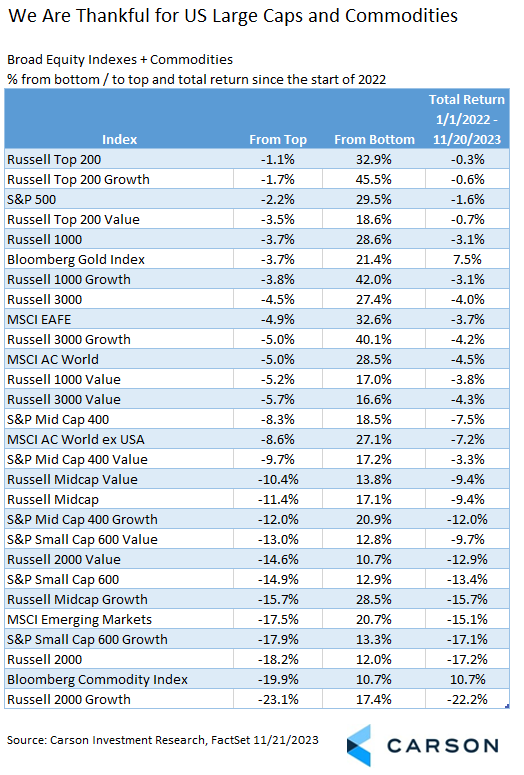

Equities and Commodities

We can be thankful for domestic large cap index returns, several of which are close to all-time highs. Large U.S. corporations remain centers of innovation and continue to show economic resilience. Even the Russell Top 200 Value Index is within 5% of its high back to the start of 2022, largely due to it not getting hit as hard during the 2022 bear market. It’s also worth noticing the MSCI EAFE Index of international developed market stocks is within 5% of its all-time high, not what many would expect. Even better, in local currency (not the return U.S. investors get but perhaps a better apples-to-apples comparison), it has actually outperformed the S&P 500!

We can also be grateful for the diversification provided by commodities. Broad commodities peaked very early in the period we’re looking at after a strong advance and have not yet been negative versus the start of 2022 in the intervening period. Gold made its low in September 2022, but remains positive over the entire period as well.

Looking ahead to 2024, we would be grateful for further equity gains and a broadening market that pulls small and mid-cap stocks along for the ride.

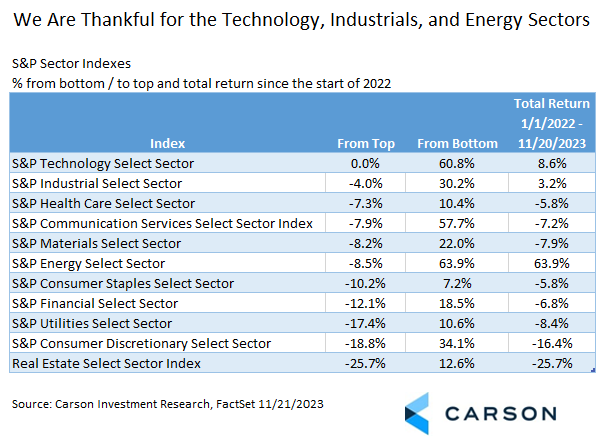

S&P 500 Sectors

We are thankful for U.S. large cap technology companies, which have anchored the broad S&P 500 Index (even though breadth has picked up nicely in recent weeks). And also for the energy sector, which powered through the volatility of 2022 and has held in there in 2023. And finally, we are grateful for the unheralded industrials sector, which made a new all-time high on a total return basis back in June to little fanfare and is one of three sectors with a gain since the start of 2022.

Looking ahead to 2024, we would be grateful for further gains but a broadening market here as well, for leadership by cyclical sectors, and for better performance from financials and real estate, just as a sign of the strength of the overall economy.

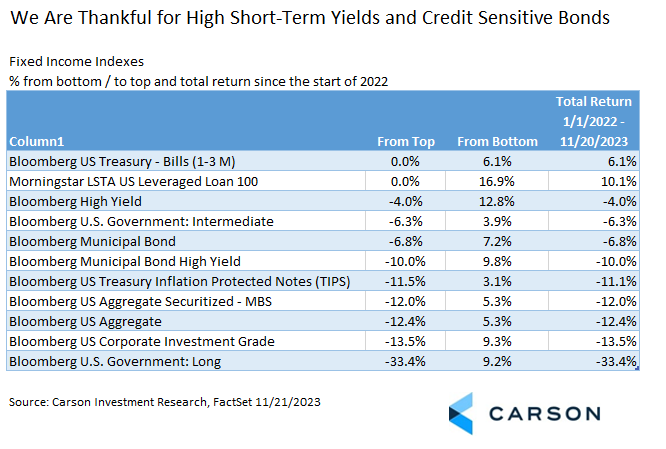

Fixed Income

Even in the fixed income universe, there have been markets worthy of gratitude. We are thankful for short-term rates finally rewarding savers after an extended drought of near-zero interest rates for nearly a decade. We are grateful for bank loans, despite their credit sensitivity, and even high-yield bonds. These are all areas the Carson Investment Research team has been leaning into in the last year.

Looking forward to 2024, we would be grateful for more resilience from broad high quality bonds as they start to reap more of the benefits of higher rates, and for credit spreads that don’t widen too much, which would signal the continued resilience of the economy.

We wish everyone a Happy Thanksgiving and look forward to all those good things we hope to be thankful for one year from now.

For more of Barry’s thoughts click here.

1994787-1123-A