Electric vehicles have secured a lasting presence in the automotive industry. Once considered mere novelties, EV-dedicated entrants like Tesla faced skepticism and incurred substantial losses in the pursuit of a seemingly inconvenient product. To much disbelief, EVs now stand strong. Tesla’s Model Y emerged as the world’s best-selling car model during the first quarter1, a remarkable outcome compared to low expectations just years ago. What was once an engineering nightmare has now proven to be not only viable but wildly profitable. This success has propelled growth in the electric vehicle market and given these companies ambitions to expand their operations. With new models entering the market, the future of electric vehicles appears promising and exciting.

The increasing market share of electric vehicles in the US is following the play book of other developed markets. Projections indicate that electric vehicles will constitute 9% of all passenger vehicles sold in the US in 2023, up from 7.3% in 20222. While this growth is significant, it lags behind China. The world’s largest car market sees electric vehicles command a substantial 33% market share3. The recent allocation of $7.5 billion for EV charging infrastructure under the Inflation Reduction Act4 may serve as a catalyst for a surge in electric vehicle adoption in the US. More charging points helps decrease both ‘range anxiety’ and wait times for charges. Additionally, the growth in the US EV market may be faster than we anticipate. In China, EVs jumped from a 5.7% share to a 27% share in merely two years. The US appears to be at a similar tipping point.

Despite the upward trajectory, the electric vehicle market has encountered recent challenges. Late 2022 ushered in a notable slowdown in the growth rates of electric vehicle sales. Higher interest rates for auto loans, among other factors, contributed to this deceleration. In response to this slower-than-expected growth, major automakers such as GM and Ford delayed and reduced investments in their EV expansion plans. Furthermore, in the wake of the UAW negotiations, there were more cuts to EV investments from these firms so that they could better support their profitable internal combustion divisions. Encouragingly, we heard from both Ford and GM in this earnings season that hybrid sales are surging. This suggests to us that consumers are gradually moving towards fully electric vehicles but require more time to embrace the transition. 2023’s slowdown in EV sales may just be a ‘speed bump’ in an otherwise rapid pace of adoption.

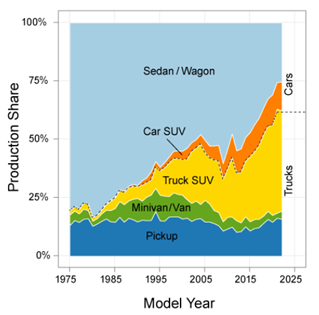

As we look to the near future, the launch of EV trucks and pickups is an exciting growth catalyst. The North American truck market is one of the fastest-growing sub-sectors in the global auto industry. Over the past decade, Americans have increasingly favored these larger, sturdier vehicles, with truck SUVs capturing an outsized share of the market. Pictured below, Truck SUVs have moved from 20% of production in 2010 to 45% of production in the latest year. And pickups have gone from just above 10% of production in 2010 to 16% in the latest model year (both data from EPA5).

This market has not had much attention paid to it from EV makers during the past decade due to cost and weight challenges. But the time may have come for electric vehicles to leave their lasting mark on this market as well. Models like the Tesla CyberTruck and Ford’s Electric Lightning, which only recently began rolling off production lines, are already impacting the market. Tesla’s CyberTruck has garnered over 1.9 million orders6, equivalent to roughly 2% of the total auto market’s annual production. And the internal combustion Ford F-Series, the best-selling automobile in the US, has a real competitor in its electric twin, the Ford Lightning. Electric vehicles may see another bout of rapid acceleration in sales as electric trucks gain traction in one of the world’s fastest growing markets.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

With such attractive design and capability innovations over the past decade, electric vehicles have shattered what consumers previously expected out of their automobiles. With over 1/3 of new vehicles in China already electric, the US appears to be following a similar timeline of adoption. Key infrastructure, such as charging stations, should help further dissipate current hesitations and win over new customers in the coming years. And with a higher share of trucks in North America than other geographies, new EV designs that accommodate to consumers looking for these bigger vehicles seem like they’re off to fast start. Despite criticism and years of challenges, the market for electric vehicles seems stronger today than ever.

- https://www.greencars.com/news/the-tesla-model-y-is-the-best-selling-car-in-the-world

- https://apnews.com/article/automakers-electric-vehicles-us-china-sales-d121c09a61f50e7357f5675af4b6056b

- https://www.ev-volumes.com/

- https://www.whitehouse.gov/briefing-room/statements-releases/2023/02/15/fact-sheet-biden-harris-administration-announces-new-standards-and-major-progress-for-a-made-in-america-national-network-of-electric-vehicle-chargers/

- https://www.epa.gov/automotive-trends/highlights-automotive-trends-report

- https://insideevs.com/news/678191/tesla-cybertruck-orders-5-year-wait-times/

02018510-1223A