Why We Think Higher Rates Didn’t Crush the Economy

“The simplest solution is almost always the best.” -William of Ockham, better known as Occam’s Razor One year ago, right now nearly all the economists on tv told us a recession was coming. Who can forget this headline from last October? In many cases it wasn’t a question of ‘if’, but how bad it would …

Bridging the Gap: Personalizing AI

In the rapidly evolving landscape of artificial intelligence, this year’s advancements mark a significant shift towards a more personal and accessible AI experience for everyday individuals. Unlike the technological strides of the past two decades, contemporary AI has seamlessly integrated into the fabric of our daily lives. It is already empowering people to accomplish mundane …

Markets to Be Thankful For

With many people on the road to visit family or preparing to host, we thought we would do a simple blog today on markets to be thankful for. We put a little wrinkle in it, though, by looking at how far different indexes are from their high and their low dating back to the start …

Talking About the Sahm Rule and Unemployment with Claudia Sahm

The Sahm Rule is an indicator that detects recessions in real-time based on changes in the unemployment rate. This rule was proposed by Claudia Sahm, a former Federal Reserve economist and a leading expert on macroeconomic policy. Today, we learn about the Sahm Rule and more! In this episode, Chief Market Strategist, Ryan Detrick & …

Six Reasons to Be Thankful

“We do the worst possible thing at the worst possible time because we are most certain that we are right just when we are most likely to be wrong.” -Jason Zweig, writer at the Wall Street Journal As we look to finish up 2023 on a strong note, there are many reasons to be …

A Charged Future: The Opportunity for Utilities

In the world of finance, the utilities sector is often considered the most boring of all. With its regulated nature and slower earnings growth, it’s not exactly the most exciting place to invest. These companies, burdened by their capital-intensive nature, funnel most of their cash into infrastructure while sparing a portion for shareholders through dividends. …

Three Things Every Investor Should Know

“Did you hear the one about the statistician who put his feet in the oven and head in a bucket of water? When asked how he felt he replied, ‘on average, I feel pretty good.’” -Old statistics joke One of my favorite parts about my job is I get to travel all over the country …

Earnings Growth Could Support 2024 Gains, But Pay More Attention to the Cycle

Forward earnings growth forecasts are a lagging indicator for markets. Truth be told, most data when reported is largely a lagging indicator for markets, since markets tend to be forward looking. Markets tend to respond to a combination of long-term fundamentals, which drive baseline expectations, surprises and shocks, and sentiment. However, it’s still very important …

Our Leading Economic Index Still Points to “No Recession”

We publicly started releasing our proprietary leading economic index (LEI) in our 2023 Mid-Year Outlook, which we use to give us an early warning signal about economic turning points. We produce an LEI for the US and 29 other countries, each one custom built to capture the dynamics of those economies. The individual country LEIs …

Why the Fed is Done

With the recent inflation data, can we say that the Fed has stopped raising rates? How will this affect the economy if this is to happen? What’s next for the stock market for the remainder of the year? In this episode, Ryan Detrick, Chief Market Strategist at Carson Group & Sonu Varghese, VP, Global Macro …

Here’s Why We Think This Inflation Report Will Set Up Serious Rate Cut Expectations

The October Consumer Price Index (CPI) report was chockful of good news. Headline inflation was flat in October, below expectations for a 0.1% increase. The October “surprise” came on the back of lower gasoline prices, which fell 5%. But that counts, and even more so because it means households have more income – keeping consumption …

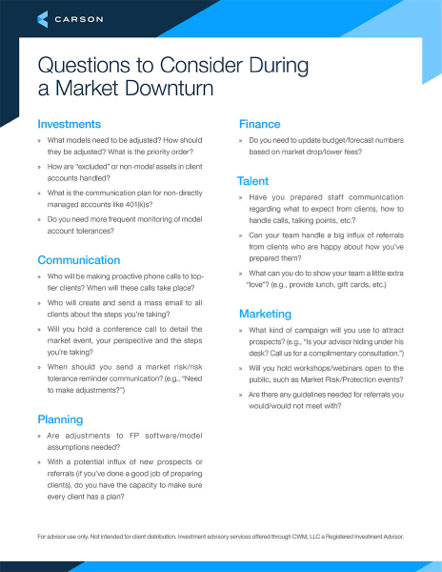

Download A Complimentary Resource

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable.