All year we’ve been in the camp that the Federal Reserve is unlikely to cut rates, and we have positioned our portfolios accordingly – overweighting cash over longer-term bonds. This was based on our view that there would be no recession in 2023, even as inflation moves lower and unemployment remains low. This was in sharp contrast to most other shops that were predicting a recession and believed that higher unemployment would be necessary to pull inflation down.

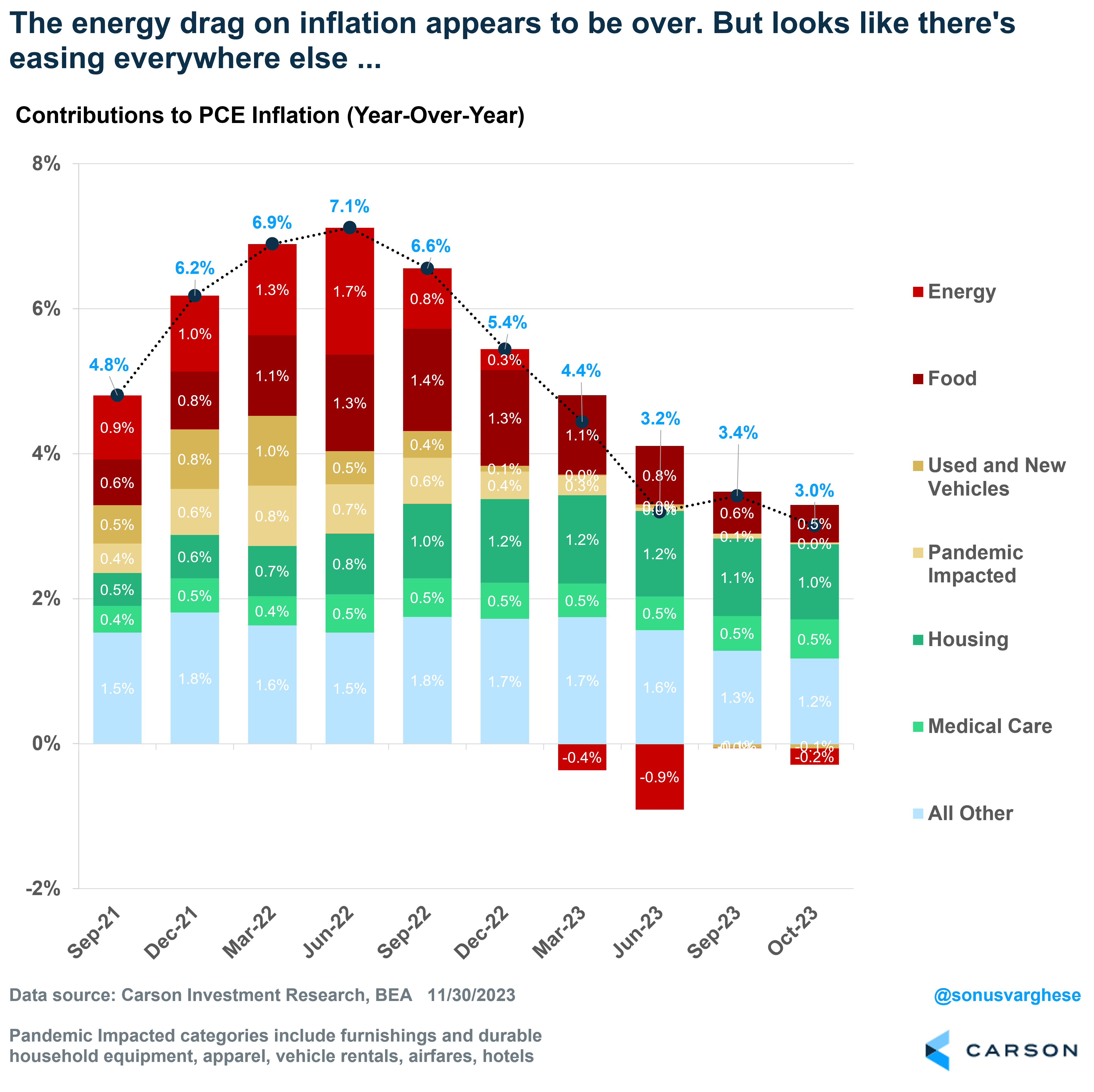

The good news is that things have played out as we expected. As of October, the Fed’s preferred inflation measure, the personal consumption expenditure index (PCE) is up just 3% since last year – that’s the lowest reading since March 2021. The big decline in inflation initially came from falling energy prices, but now we’re seeing disinflation in every other major category.

Even better, disinflation is happening where it matters most as far as the Fed is concerned. Core PCE, which excludes food and energy, is running at a 2.4% annualized pace over the last three months, and 2.5% over the last six.

What About the Last Mile of Inflation?

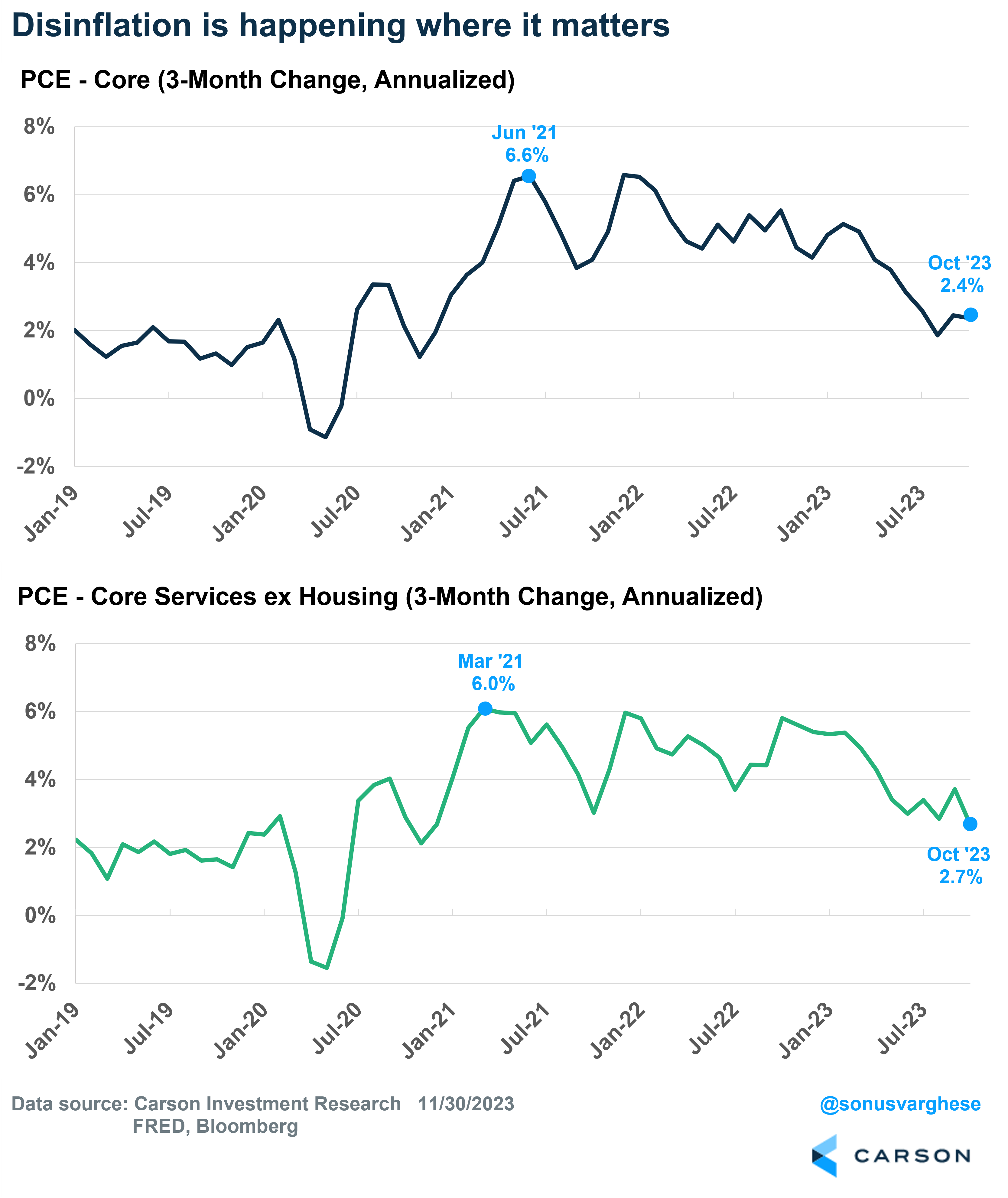

There’s been a lot of worry that the last mile of inflation would be the hardest, with the Fed focusing on core services ex housing. Progress in this category tends to depend on demand weakening. By contrast, a stronger economy, low unemployment, and strong income gains could keep it elevated. The theory is that unemployment would have to rise significantly for disinflation to happen here.

Stay on Top of Market Trends

The Carson Investment Research newsletter offers up-to-date market news, analysis and insights. Subscribe today!

"*" indicates required fields

But despite strong demand, the news has still been good so far. PCE for core services ex housing is running at an annualized pace of just 2.7% over the past three months, and 3.0% over the past six.

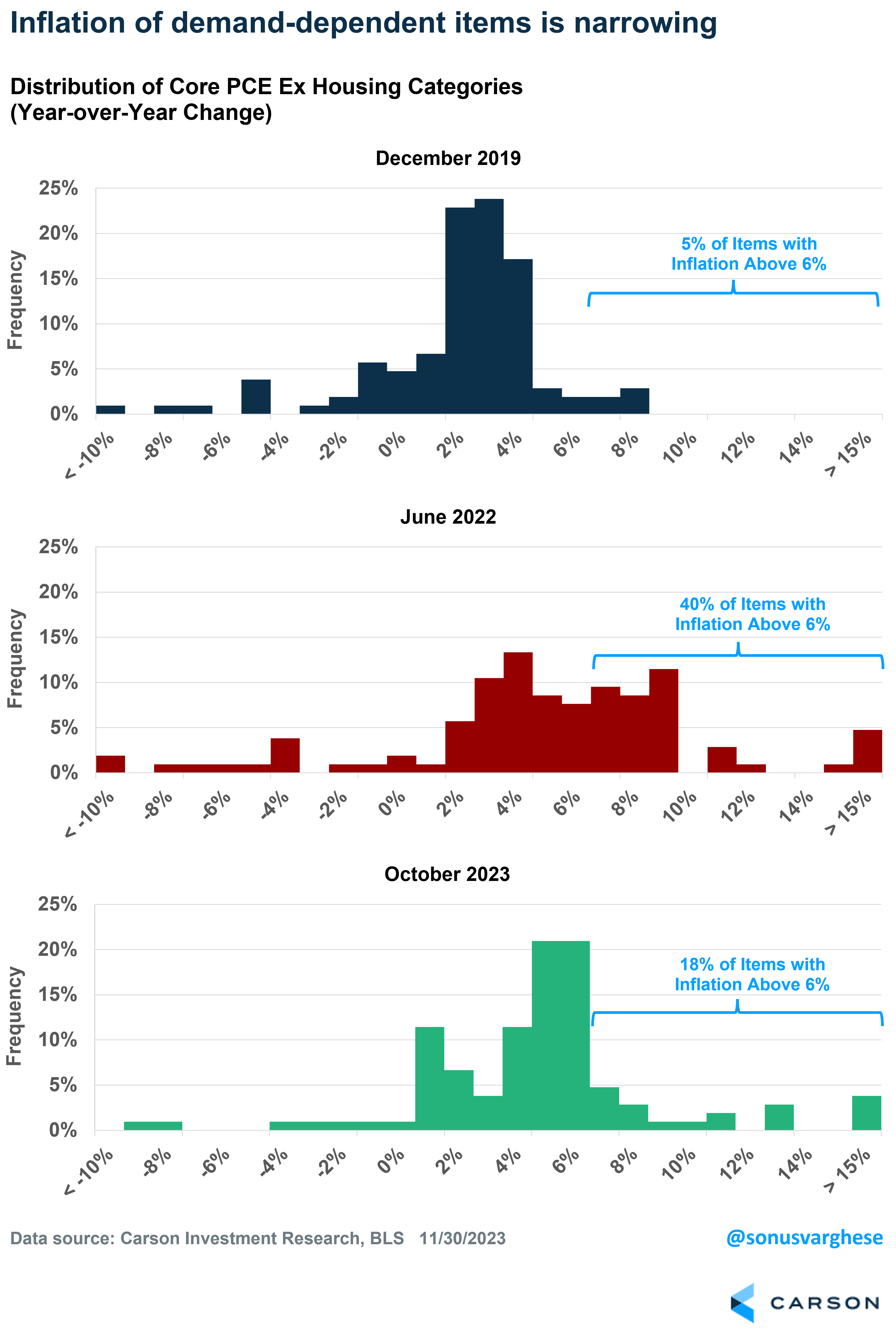

I also looked at all the items that make up “core services ex housing” – there are about 105 of them – and calculated the distribution of year-over-year price increases for all of them in 3 periods:

- December 2019, before the pandemic

- June 2022, when inflation peaked

- October 2023, the most recent data

The chart below shows how the distribution has evolved. You can see that inflation really broadened out by June 2022, with 40% of items seeing inflation rates above 6%. But things have pulled back since then, and we’re now much closer to where we were before the pandemic. Only 18% of items are now seeing inflation above 6%.

Obviously, we’re not all the way back, but there’s been a lot of progress. Even more important, it’s happened with an unemployment rate that has stayed below 4%.

The Groundwork for Rate Cuts Is Being Laid Out

The good news is that Fed officials are acknowledging that inflation can fall even as the economy remains strong and unemployment stays low. On top of that, we expect disinflation to continue into 2024. In a prior blog, I discussed how falling vehicle prices and rents are likely to push core inflation very close to the Fed’s target in 2024.

At their September meeting, Fed members projected core PCE to be 3.7% in 2023 and 2.6% in 2024. They also projected two rate cuts in 2024 based on these inflation expectations.

Here’s the thing: Core PCE is running at a year-over-year pace of 3.5%, and as I noted earlier, the 6-month pace is just 2.5%. That pace is already ahead of the Fed’s estimates, and we just have to look at their own projections to understand what comes next.

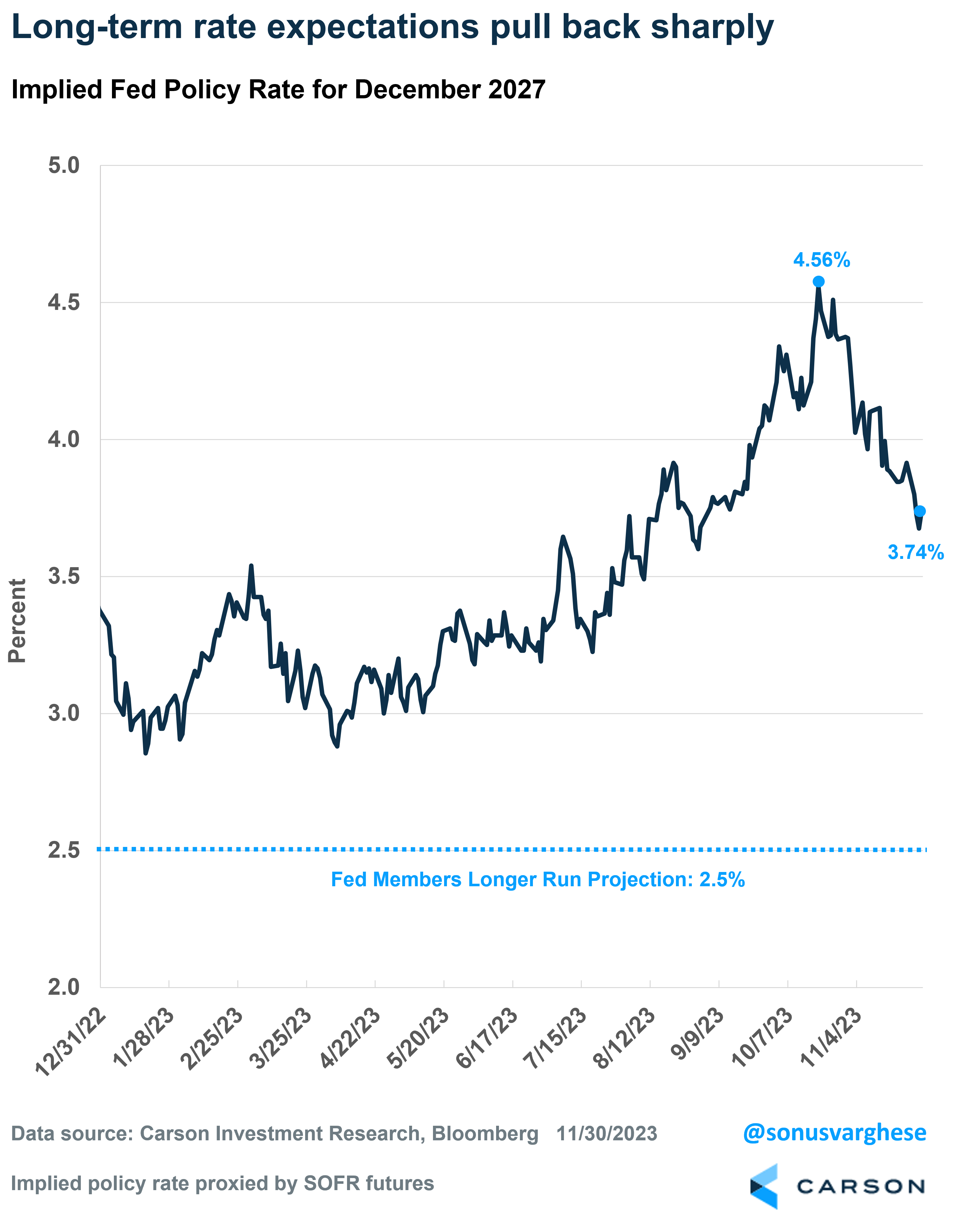

Not only are there no more rate hikes coming, but the groundwork is in place for a pivot to rate cuts in 2024. Investors are currently pricing in close to 50% odds for the first 0.25%-point rate cut to happen by March and two cuts by June. We’re a tad skeptical that the Fed will cut as early as March – they’ll likely want to see a little more data before proceeding with the first cut – but one rate cut by June is possible.

Over the full year, investors expect the federal funds rate to fall from its current range of 5.25 – 5.50% to the 4.0 – 4.25% range (the equivalent of 4-5 rate cuts). At this point, given our expectations for a fairly robust economy in 2024, it’s hard to see the Fed cutting that many times. What’s more likely is that the Fed will pursue a few “insurance” cuts, especially if we get a run of weaker economic data that raises the risk of a recession. It may be similar to what the Fed did in 1995-1996, when they cut rates by about 0.75%-points after an aggressive rate hike cycle in 1994. The labor market stayed strong, business investment rose, and we got several years of higher productivity growth.

Long-term interest rates are also falling as investors now expect longer-term policy rates to be in the vicinity of 3.5-4-4.0%, rather than 4.5%. That’s still higher than the Fed’s long-term expectation of just 2.5%, but that means investors expect a stronger economy in the future than the Fed does.

In any case, lower interest rates are a big potential tailwind for the economy, as it can push mortgage rates lower, which will boost housing activity. Lower rates can also spur business investment and the more cyclical parts of the economy like manufacturing.

All said and done, 2024 is shaping up quite nicely for the economy, and company profits. This macro backdrop will be good for stocks and could potentially lead to another year of solid gains. Ryan and I talked about November’s strong stock market gains and what could be next in our latest Facts vs Feelings episode. Be sure to listen:

For more of Sonu’s thoughts click here.

2005480-1223-A