Leading with Marketing: How a Renewed Focus Helped One Firm Double Its AUM in 3 Years

“It’s amazing how creative and strategic you can be when you don’t have to worry about a lot of the minutiae of running a practice.” While working as an advisor at a national broker-dealer, Neal McGrath, founder, Managing Partner and Senior Wealth Advisor at Aptus Wealth Planning, found that he couldn’t be nimble enough to …

The Financial Advisor’s Guide to the SECURE 2.0 Act

Unlike its predecessor, the SECURE 2.0 Act makes major revisions to help Americans save for retirement, which advisors need to understand. The new rules bring plenty of changes for retirees, workers, employers and small business owners. Congress made a clear effort to call out the importance of having an emergency fund and college funding, and …

The Financial Advisor’s Guide to Effective Marketing

It can be tough for an advisor to stand out in today’s digital world. Sure, there are more avenues than ever to raise awareness of your firm – both paid and free – but they’re as loud and overcrowded as the trading floors of 50 years ago during a buying rush.

Business Management

How the Proposed Capital Gains Tax Could Affect Your Advisory Firm

Learn how your firm’s valuation could fluctuate under the proposed increased capital gains tax rate. To fund his American Families Plan, President Joe Biden has proposed an increase in the capital gains tax that extends its reach to advisors in the market to sell. A proposed hike from 20% to 39.6% would start in 2022, …

CARES Act Summarized

A Look at the Major Provisions of the Coronavirus Aid, Relief, and Economic Security Act As the stock market hit its lowest returns since the 2008 Financial Crisis, the government has stepped in in an attempt to boost the economy. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) produces roughly $2 trillion in …

The Top Ways for Advisors to Provide Value to Clients

Download the Top Ways for Advisors to Provide Value to Clients You know you provide value to your clients – but do they? Demonstrating your value to clients helps them feel more confident and secure in you and in their financial decisions. Learn what services you should highlight and how clients feel about compensation and …

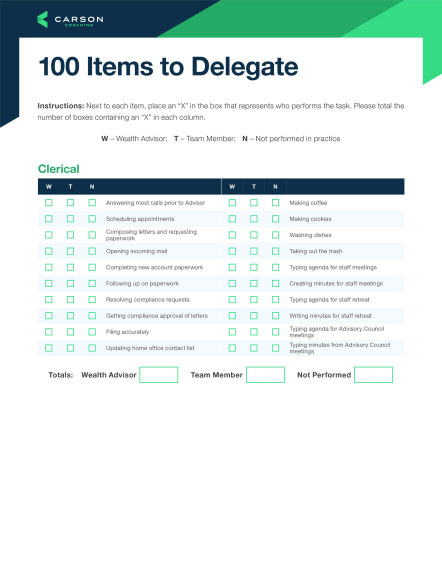

100 Tasks Every Advisor Should Delegate

Find out what tasks you can hand off to free up your time and empower your team.

Marketing

Leading with Marketing: How a Renewed Focus Helped One Firm Double Its AUM in 3 Years

“It’s amazing how creative and strategic you can be when you don’t have to worry about a lot of the minutiae of running a practice.” While working as an advisor at a national broker-dealer, Neal McGrath, founder, Managing Partner and Senior Wealth Advisor at Aptus Wealth Planning, found that he couldn’t be nimble enough to …

The Financial Advisor’s Guide to Effective Marketing

It can be tough for an advisor to stand out in today’s digital world. Sure, there are more avenues than ever to raise awareness of your firm – both paid and free – but they’re as loud and overcrowded as the trading floors of 50 years ago during a buying rush.

How One Advisor Left His Broker-Dealer and Found Independence

Without a continuity plan, Joel Worsfold knew his legacy, his clients and his team were at risk. And beyond that, his technology and client experience was outdated. Joel recognized the common thread: his broker-dealer.

The Financial Advisor's Guide to Effective Marketing

Effective advisor marketing in the digital age requires a strategy that fits your firm.

Compliance

CARES Act Summarized

A Look at the Major Provisions of the Coronavirus Aid, Relief, and Economic Security Act As the stock market hit its lowest returns since the 2008 Financial Crisis, the government has stepped in in an attempt to boost the economy. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) produces roughly $2 trillion in …

Four Ways the CARES Act Can Help Your Advisory Firm

From loans to tax breaks to credits, the CARES Act attempts to provide relief to small- and medium-sized businesses, which includes most advisory firms. There are four main provisions in the CARES Act that can help you as a business owner: Paycheck Protection Program Economic Injury Disaster Loans Employee Retention Credit The delay of employer …

CARES Act Summarized

A Look at the Major Provisions of the Coronavirus Aid, Relief, and Economic Security Act. As the stock market hit its lowest returns since the 2008 Financial Crisis, the government has stepped in in an attempt to boost the economy. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) produces roughly $2 trillion in …

Staying on Top of SEC Marketing Rule Changes

Learn how to stay in compliance with SEC rules when using client testimonials and reviews.

Technology

Tax-Planning Software Holistiplan Comes to Carson

What if you had technology that could read a client’s tax return, analyze it and give you a solid starting point for their financial plan, all in a matter of minutes? Think of all you could do to better your business and deepen client relationships with that saved time. Check out our case study, …

How Technology and Partnership Helped One Firm Break Through

How One Firm Utilized Technology and Partner Firms to Have One of Its Best Years Ever “You’re here to help, not sell. If you’re perceived as a service provider, not a product guy, you’re going to get business.” The finance world moves quickly. The markets change, the 24-hour news cycle transforms the landscape, and technology …

How BMY Wealth Improved Client Relationships – and Increased AUM – with the New Carson CX

How BMY Wealth Improved Client Relationships – and Increased AUM – with the New Carson CX “Just by going step by step through the CX program – not hopping around or trying to guess at what the client wants – we are able to show our value a lot more clearly.” – Justin Haschke, Owner and …

Building a Top-of-the-Line Tech Stack

An accessible, user-friendly tech stack is crucial to delivering the best client experience.

Investments

Carson’s Investment Guidebook

Carson Partners benefit from investment strategies built with a planning-first mindset, and the Carson Investment Guidebook takes you through our philosophy of doing just that – from financial planning to investments, measuring risk to measuring diversification, and everything in between. We are committed to helping clients understand their portfolios and to provide a narrative around …

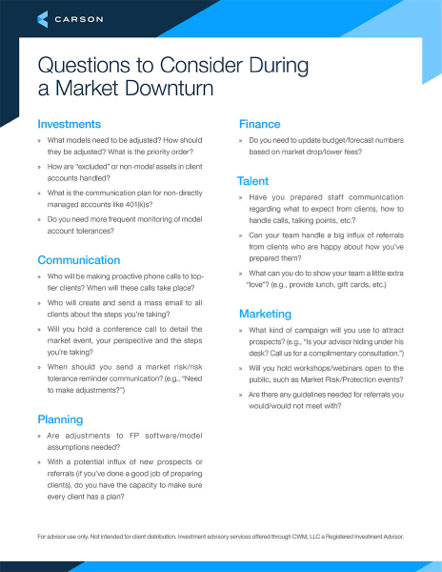

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable. Market downturns are unpredictable and inevitable – but your response doesn’t need to be. We built this list of market downturn questions to help you create a stable path through the unstable days of the market, and everything that entails – from nervous clients to …

Carson Group’s Investment Strategies

Quickly navigate the various investment options for Carson Partners with our Investment Strategies Fact Sheet. You’ll find options for every type of investor – from a beginner to an individual with a high net worth. Download

Questions to Consider During a Market Downturn

Prepare yourself, your clients and your team for the inevitable.

Financial Planning

The Financial Advisor’s Guide to the SECURE 2.0 Act

Unlike its predecessor, the SECURE 2.0 Act makes major revisions to help Americans save for retirement, which advisors need to understand. The new rules bring plenty of changes for retirees, workers, employers and small business owners. Congress made a clear effort to call out the importance of having an emergency fund and college funding, and …

Planning in 2020: RMDs, Retirement Planning After the CARES Act

Retirement planning in 2020 was flipped on its head when Congress passed the CARES Act, a $2 trillion economic relief package aimed at helping both individuals and businesses. The impact on retirement planning was significant: RMDs are eliminated in 2020 For those who already took RMDs, the 60-day rollover option was extended The early withdrawal …

CARES Act Summarized

A Look at the Major Provisions of the Coronavirus Aid, Relief, and Economic Security Act. As the stock market hit its lowest returns since the 2008 Financial Crisis, the government has stepped in in an attempt to boost the economy. The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) produces roughly $2 trillion in …

How SECURE 2.0 Act Shifts the Retirement Planning Landscape

Stay on top of the shifting retirement planning picture.

M&A

How One Advisor Left His Broker-Dealer and Found Independence

Without a continuity plan, Joel Worsfold knew his legacy, his clients and his team were at risk. And beyond that, his technology and client experience was outdated. Joel recognized the common thread: his broker-dealer.

Find Out if Partnership is the Best Fit for Your Firm

Are We a Fit for Your Firm? As you explore partnership, you should understand what types of firms work best in our ecosystem – both in the transition phase and the years after. Learn what we look for in partners, including culture, assets under management, compliance record and more in our “Find Out if …

The Top Ways for Advisors to Provide Value to Clients

Download the Top Ways for Advisors to Provide Value to Clients You know you provide value to your clients – but do they? Demonstrating your value to clients helps them feel more confident and secure in you and in their financial decisions. Learn what services you should highlight and how clients feel about compensation and …

The Essentials of Succession Planning for Financial Advisors

Learn how to choose a successor and find the true value of your firm.

Get Expert Market Insights

The Carson Investment Research weekly newsletter offers up-to-date market news and analysis that could help you serve as a better guide for your clients. Subscribe today!

"*" indicates required fields